Validating business buyer proof of funds is the difference between six months well spent and six months wasted.

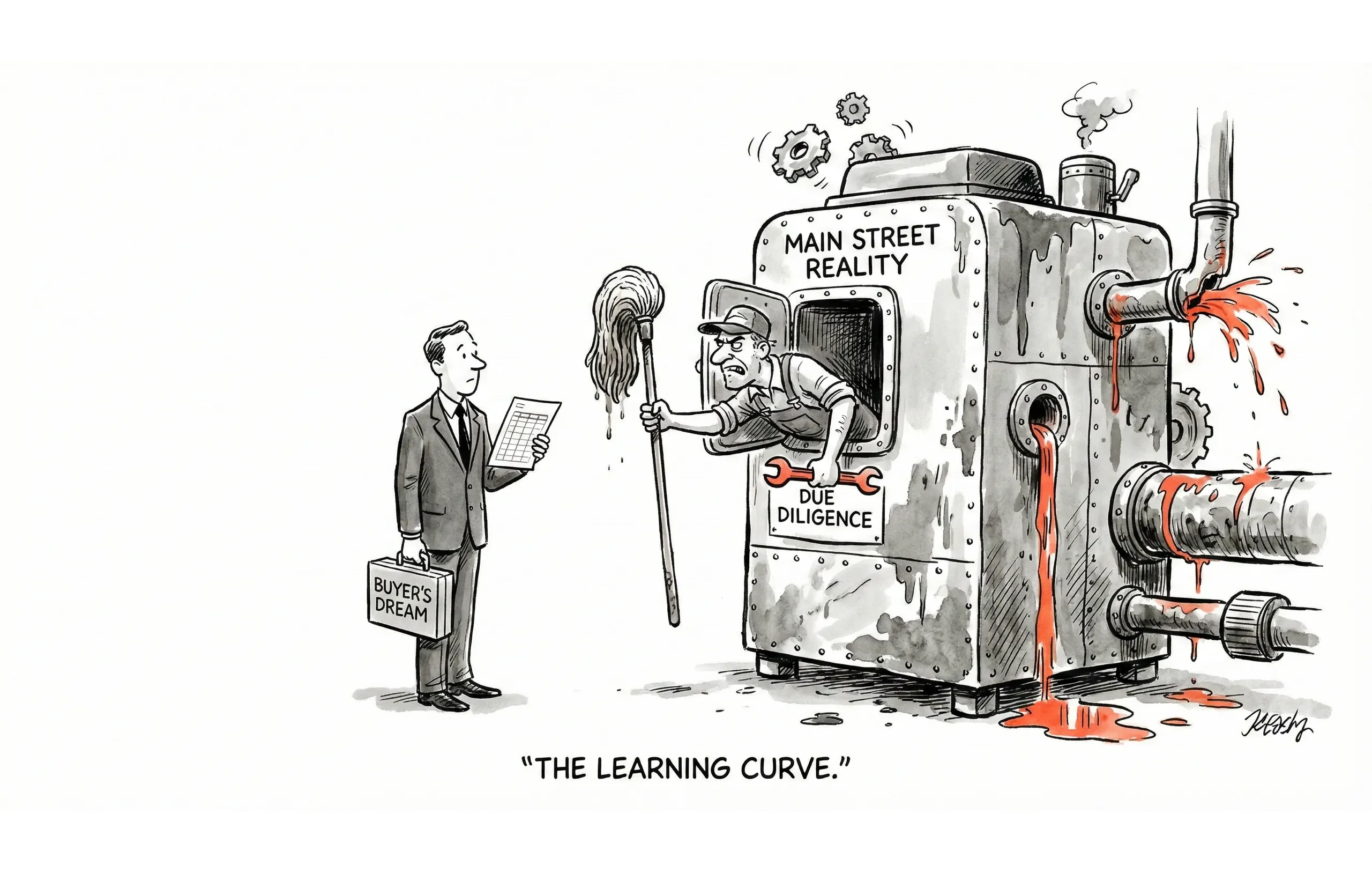

You spend months nurturing a buyer. They ask the right questions, they seem to understand the industry, and they even nod along during the valuation talk. You finally get them to the LOI stage, the seller is excited, and you're already mentally spending that commission check.

Then comes the financing contingency.

Suddenly, the "liquid capital" they bragged about turns out to be unvested crypto, a "promised" inheritance from an aunt who is still very much alive, or equity in a house they haven't listed yet. The deal implodes. The seller is furious. You've wasted half a year on a phantom buyer.

Business buyer proof of funds isn't just paperwork; it's the primary firewall protecting your time and your seller's sanity. Without verified financial capability, every other qualification factor is noise.

This guide covers exactly what constitutes acceptable proof of funds documentation, how to verify it without killing the vibe, and how to politely but firmly show the "tire kickers" the door.

Why Business Buyer Proof of Funds Verification Matters

You know the old industry saying: "Figures don't lie, but liars figure."

In the world of Main Street and Lower Middle Market brokerage, financing is the number one deal killer. According to industry data from BizBuySell, only about 20% of listed small businesses actually sell. Furthermore, anecdotal data from broker roundtables suggests that of the deals that do go under contract, nearly 50% fail to close, with financing issues being a top-three culprit.

Verifying business buyer proof of funds early serves four critical purposes:

- Protects Your Time: It filters out the "dreamers" who treat browsing business listings like window shopping.

- Protects Your Seller: Sharing sensitive financial data (CIMs) with unqualified parties is a breach of trust.

- Sets the Tone: It establishes you as a professional who runs a tight ship.

- Reality Check: It forces the buyer to organize their own capital stack before they get emotionally involved.

Business Buyer Capital Requirements: How Much Proof of Funds?

A common mistake brokers make is accepting proof of funds that covers just the down payment. This is a recipe for a stress-induced ulcer later in underwriting.

Minimum Capital Requirements

For the standard SBA 7(a) acquisition loan—the lifeblood of Main Street deals—the absolute floor is a 10% equity injection. However, lenders are tightening their belts. A buyer showing up with exactly 10% is risky; one unexpected hiccup in the valuation or a slight reduction in seller financing, and the deal dies.

Deal Size | Minimum Down (10%) | Recommended Liquidity (20%) | Total "Safe" Range* |

|---|---|---|---|

$500,000 | $50,000 | $100,000 | $75,000 - $150,000 |

$750,000 | $75,000 | $150,000 | $110,000 - $220,000 |

$1,000,000 | $100,000 | $200,000 | $150,000 - $300,000 |

$1,500,000 | $150,000 | $300,000 | $225,000 - $450,000 |

$2,000,000 | $200,000 | $400,000 | $300,000 - $600,000 |

Total includes down payment + post-closing working capital (5-10%) + closing costs (2-3%).

The 20-25% Rule of Thumb

Experienced brokers often look for liquid assets equal to 20-25% of the target acquisition price. This "buffer" signals to lenders (and you) that the buyer isn't stretching themselves to the breaking point.

Cash Deals

If a buyer claims to be a cash buyer, they need to show 100% of the purchase price plus 10% for closing/transition costs. No exceptions. "Cash buyer" is often code for "I haven't talked to a bank yet," so verify business buyer proof of funds aggressively here.

Acceptable Business Buyer Proof of Funds Documentation

Not all documents are created equal. When a buyer sends you a file, categorize it immediately into one of these three tiers.

Tier 1: The Gold Standard

These documents let you sleep at night.

- Bank Statements (Personal or Business): The holy grail. Look for the last 2-3 months to ensure the money didn't just appear yesterday (a sign of borrowed funds "seasoning"). Name must match the buyer.

- Investment Account Statements: Brokerage accounts (stocks, bonds, mutual funds) are excellent, provided they are non-retirement (or the buyer understands the tax hit/ROBS process).

- SBA Pre-Qualification Letter: Specifically one from an SBA Preferred Lender that details a review of the buyer's financials, not just a generic "we lend up to $5M" marketing flyer.

- Approved Line of Credit: A formal letter showing available, undrawn capacity.

Tier 2: Acceptable with Context

Trust, but verify.

- CPA or Financial Advisor Letter: Must be on professional letterhead, dated within 60 days, and explicitly state "liquid assets in excess of [Amount]."

- 401(k)/IRA Statements (ROBS): Acceptable only if the buyer explicitly confirms they plan to use a Rollover for Business Startups (ROBS) strategy. This adds complexity and time, so adjust your closing expectations.

- HELOC (Home Equity Line of Credit): Only if it is already approved and undrawn.

Tier 3: Acceptable with Caution

Proceed with eyes wide open.

- Trust Account Statements: Who controls the switch? You need to verify the buyer has beneficial access to these funds without jumping through impossible hoops.

- Foreign Bank Statements: These require translation and currency conversion verification. You also need to vet the transferability of funds—capital controls in some countries can freeze deals instantly.

Unacceptable Proof of Funds: What to Reject

If a buyer presents these, you are likely dealing with a tire kicker.

"I have the money" (Verbal Assurance) A verbal promise and $5 will buy you a cup of coffee. It won't buy a business.

- Real Estate Equity (No HELOC): "I'm going to sell my house to buy this business." No, they aren't. Or if they are, it will take 6 months. This is not liquidity; this is a contingency nightmare.

- Crypto Wallets: Extremely volatile. Lenders generally hate it. Unless they liquidate it into USD and put it in a bank, it doesn't count.

- "My Partner has the Money": Then the partner needs to sign the NDA and send the proof of funds. You are not brokering a deal with a ghost.

- Future Income/Inheritance: "I have a settlement coming next month." Call me next month.

Red Flags to Spot

Watch for these warning signs when reviewing business buyer proof of funds:

- Round Numbers Only: Bank accounts rarely have exactly $500,000.00. They have $501,243.82. Perfect numbers often indicate a screenshot edit.

- Different Names: "Oh, that's my wife's account." "That's my holding company." Verify the link between the entities.

- Old Dates: In this economy, a statement from 6 months ago is irrelevant.

Related: Buyer Red Flags: Warning Signs Every Broker Should Know

How to Verify Business Buyer Proof of Funds

You don't need to be a forensic accountant, but you do need to be thorough.

- The "Sanity Check": Does the total liquid amount meet the 20-25% threshold?

- The Identity Match: Does the name on the bank statement match the name on the NDA?

- The Date Check: Is it within the last 60-90 days?

- The "Source" Check: Look for large, unexplained deposits on bank statements. A sudden $200k deposit the day before the statement closed might be a loan from a friend just to "show" proof of funds—this is fraud if not disclosed to the lender.

Pro Tip: If you have a high-value deal ($5M+), consider requesting a Bank Verification Letter directly from the institution or a brief call with their banker.

Handling Business Buyer Proof of Funds Objections

Buyers can be sensitive about their money. Here is how to handle common objections without losing rapport.

Scenario A: "I don't feel comfortable sending my bank statements."

The Pivot: "I completely understand. Privacy is paramount. We don't need to see your transaction history—feel free to redact account numbers and line-item transactions. We just need to see the Institution Name, Your Name, the Date, and the Bottom Line Balance. Alternatively, a letter from your CPA on their letterhead works perfectly."

Scenario B: "My partner is funding the deal."

The Pivot: "That's great. To move forward, I'll just need your partner to sign our standard NDA and provide the proof of funds. Since they are the capital source, the seller requires we vet them just as we vetted you."

Scenario C: The "Asset Rich, Cash Poor" Buyer

The Pivot: "You have an impressive real estate portfolio. However, for this acquisition, the lender will require liquid capital for the equity injection. Have you applied for a HELOC yet? If we can get that approval letter, we can proceed."

When to Request Proof of Funds from Business Buyers

Don't ask for a bank statement on the first cold call—that's like proposing on the first date. But don't wait until the wedding day, either.

Stage | Action |

|---|---|

Inquiry | Verbal check: "Do you have the 10-20% capital requirement liquid?" |

Post-Discovery Call | Hard Stop. Request formal documentation here. |

Pre-CIM | Verify the docs before sending the Confidential Information Memorandum. |

Pre-LOI | Refresh the docs if they are >60 days old. |

Email Template: The "Soft Ask"

Subject: Next Steps for [Business Name] Opportunity

"Thanks for the great call today, [Name]. To move to the next stage and release the Confidential Information Memorandum (CIM), our sellers require us to verify financial capability. Please attach proof of liquid funds covering at least $[Amount] (bank statement, brokerage statement, or CPA letter). Feel free to redact account numbers—we just need to verify the name and the total liquid balance."

Frequently Asked Questions About Business Buyer Proof of Funds

What qualifies as proof of funds for a business buyer?

Acceptable business buyer proof of funds includes bank statements (personal or business), investment account statements, SBA pre-qualification letters from preferred lenders, and approved lines of credit. CPA letters and HELOC approvals are also acceptable with proper verification. The documentation must be dated within 60-90 days and show the buyer's name matching their NDA.

How much proof of funds should a business buyer show?

Business buyers should demonstrate liquid assets equal to 20-25% of the target acquisition price. This covers the 10% minimum SBA equity injection plus working capital reserves (5-10%) and closing costs (2-3%). For example, a buyer pursuing a $1M business should show $150,000-$300,000 in verified liquid funds.

When should brokers request proof of funds?

Request verbal confirmation of capital availability during the initial inquiry call. Make the formal proof of funds request a hard stop after the discovery call—before releasing the CIM. This protects seller confidential information and filters unqualified buyers early. Refresh documentation if it becomes more than 60 days old before LOI.

Can buyers use retirement accounts as proof of funds?

Yes, but only if the buyer confirms they plan to use a ROBS (Rollover for Business Startups) strategy. This involves rolling 401(k) or IRA funds into a new C-corporation to fund the acquisition without early withdrawal penalties. ROBS adds complexity and 4-6 weeks to the timeline, so adjust closing expectations accordingly.

What are red flags in business buyer proof of funds?

Watch for round numbers (real accounts have cents), names that don't match the NDA, statements older than 90 days, large unexplained deposits (possible "flash" funds), and documentation from partners who haven't signed the NDA. Also be wary of crypto holdings, unvested stock options, or promised inheritances presented as liquid capital.

Do cash buyers need proof of funds?

Absolutely. Cash buyers must show 100% of the purchase price plus 10% for closing and transition costs. "Cash buyer" is often code for "I haven't talked to a bank yet." Verify aggressively—cash claims without documentation are the most common tire-kicker profile in business brokerage.

Conclusion

As a broker, your inventory is the business, but your currency is certainty.

By enforcing strict business buyer proof of funds requirements, you aren't being difficult—you're being a professional. You are ensuring that when you bring an offer to a seller, it's worth the paper it's written on.

Next Step: Review your current pipeline. Do you have any active buyers who haven't provided Tier 1 documentation yet? Send the "Soft Ask" email template above to them today and clean up your list.