What Is a CRM for Business Brokers?

A CRM for business brokers is specialized software that centralizes buyer data, listing information, deal pipelines, and transaction workflows. Unlike general CRMs, broker-specific systems include NDA management, buyer-listing matching algorithms, SDE/EBITDA tracking, and deal stage automation tailored to M&A transactions.

Key components:

- Contact database (buyers, sellers, intermediaries)

- Deal pipeline visualization (teaser to closing)

- Document management (NDAs, CIMs, financials)

- Task automation and deadline tracking

- Commission and fee tracking

We’ve all been there. You have a solid listing, a willing seller, and a buyer who claims to have the dry powder ready to deploy. You’re weeks into the dance, sending over P&Ls and fielding questions. Then, silence.

By the time you dig through your email threads to realize you missed a critical follow-up on an add-back question, the buyer has moved on to another deal. That "perfect deal" didn't die because of valuation gaps or financing issues—it died because you lacked a proper CRM for business brokers to manage the workflow.

A well-configured CRM is the operational backbone of a brokerage practice. It’s the difference between being a reactive firefighter and a proactive dealmaker. With statistics showing that up to 90% of individuals who begin the search to buy a business never complete a transaction, your ability to organize the chaos and identify the serious buyers from the "tire kickers" is your only real leverage.

Choosing and implementing the right system can dramatically improve efficiency, but the wrong choice creates friction and wastes time.

CRM Categories for Business Brokers

When you're shopping for a CRM, you're essentially choosing between a bespoke suit and something off-the-rack that you take to a tailor. Both have their place depending on the size of your firm.

Industry-Specific CRMs

These platforms (think DealRelations, Vertica, or Business Intermediary-focused tools) speak our language right out of the box. They know what an NDA is, they understand the difference between an Asset Sale and a Stock Sale, and they often come pre-loaded with document templates.

Advantages:

- Built-in broker workflows: Pipeline stages like "Teaser Sent," "NDA Signed," and "LOI Received" are default settings.

- Industry terminology: No need to rename "Product" to "Listing."

- Buyer-listing matching: Algorithms that automatically flag buyers when you upload a listing that matches their EBITDA or geographic criteria.

- Broker-specific reporting: Commission splits and success fee tracking are often native.

Disadvantages:

- Higher cost typically: Niche software lacks the economy of scale of the giants.

- Less customization: You often have to adapt your process to their software, rather than the other way around.

- Smaller vendor ecosystem: Fewer third-party apps (like Zapier or marketing automation tools) may connect easily.

- Potential feature bloat: You might pay for valuation modules you never use.

General-Purpose CRMs

These are the heavy hitters like Salesforce, HubSpot, or Pipedrive. They are powerful blank slates.

Advantages:

- Lower cost options: Entry-level tiers are often very affordable.

- Highly customizable: You can build virtually any workflow if you have the patience (or a consultant).

- Large integration ecosystem: If you use Outlook, Gmail, DocuSign, or QuickBooks, these CRMs integrate seamlessly.

- Widespread support resources: You can Google a problem and find a thousand tutorials.

Disadvantages:

- Requires configuration: You will spend hours customizing fields to track "SDE" instead of "Annual Revenue."

- No built-in broker workflows: You have to build the deal pipeline from scratch.

- Generic terminology: Expect to see "Lead" and "Opportunity" instead of "Buyer" and "Listing."

- More setup time: The "blank slate" can be overwhelming for smaller shops.

Essential CRM Features for Business Brokers

In a profession where sales reps spend only about 30% of their time actually selling, the features you choose should be focused entirely on buying back your time.

Must-Have Features

Feature | Why Essential |

|---|---|

Contact management | You need a central database to tag "VIP Buyers" vs. "Window Shoppers." |

Deal/pipeline tracking | Visualizing your deal flow prevents the "what's the status on the Johnson file?" panic. |

Activity logging | "Did I call him last Tuesday or Wednesday?" The system should tell you automatically. |

Task management | Deal fatigue kills transactions; automated follow-up reminders keep momentum alive. |

Document storage | Centralized files for NDAs, CIMs, and financials are non-negotiable for compliance. |

Search/filtering | Quick retrieval of "Manufacturing buyers with >$1M EBITDA criteria" is a superpower. |

Mobile access | Deals happen on the road, not just behind a desk. |

Nice-to-Have Features

Feature | Value |

|---|---|

Email integration | Automatic logging of every email ensures a complete audit trail without data entry. |

Calendar sync | Avoids the "double-booking" embarrassment during due diligence meetings. |

Buyer matching | Automated recommendations that pair new listings with old buyer inquiries. |

Reporting/analytics | Insights into which lead sources (BizBuySell vs. LinkedIn) are actually closing. |

E-signature integration | Streamlined execution of NDAs removes a major friction point. |

Data room integration | Managing the Due Diligence waterfall from within your CRM. |

CRM Evaluation Criteria for Business Brokers

Before you commit to a subscription, run the software through this scoring framework. I've seen brokers waste months on platforms that looked great in demos but collapsed under real-world deal complexity. Remember, the goal is to reduce the administrative burden, not increase it.

Scoring Framework

Criterion | Weight | Questions |

|---|---|---|

Workflow fit | High | Does it match how you actually close deals, or how a software engineer thinks you close deals? |

Ease of use | High | Will you actually use it? (The best CRM is the one you log into). |

Data security | High | Are your client's P&Ls and tax returns safe? |

Mobile capability | Medium | Can you pull up a buyer's profile while walking into a lunch meeting? |

Integration | Medium | Does it talk to your email and e-signature tools? |

Reporting | Medium | Can it tell you your projected commission for Q4? |

Cost | Medium | Is the ROI there? (Remember, CRM ROI can be upwards of $30 for every dollar spent). |

Support | Low | Is there a human to talk to when the system goes down? |

Red Flags

- Requires extensive customization to fit basic workflows: If you have to hire a developer just to add a "Listing Price" field, run.

- Poor mobile experience: If the app is just a clunky web wrapper, it won't work in the field.

- Limited search capabilities: You need to be able to search by industry, geography, and deal size simultaneously.

- No document management: If you have to store files in a totally separate disconnected system, you're doubling your work.

- Complicated data export: Your data is your asset. If they make it hard to leave, they don't trust their product.

How to Choose the Right CRM for Your Brokerage

- Define workflow requirements — Map your current deal process from prospecting to close

- Determine must-have features — Prioritize contacts, deals, and document management

- Set your budget — Calculate total cost of ownership ($100–$400/user is typical)

- Test 3–4 platforms — Request demos and 14–30 day free trials

- Evaluate mobile capabilities — Ensure native apps work offline

- Check integrations — Verify email, e-signature, and listing platform connections

- Review data security — Confirm SOC 2 compliance and encryption standards

- Assess scalability — Choose platforms that grow with your firm

- Test customer support — Submit real questions during your trial period

- Plan implementation — Allocate 2–8 weeks for setup and team adoption

CRM Implementation Best Practices for Business Brokers

Buying the software is the easy part. Implementing it without disrupting your current deal flow is the challenge. I've guided dozens of brokerages through this process—here's the proven three-phase approach:

Phase 1: Setup

- Configure pipeline stages: Map your real-world process (e.g., Prospecting -> NDA -> CIM Review -> Mgmt Meeting -> LOI -> Due Diligence -> Closing).

- Set up custom fields: Add broker-specific data points like "SDE," "EBITDA Multiples," "Reason for Sale," and "Add-backs."

- Import existing contacts: Don't start empty.

- Create folder/tag structure: Tag contacts as "PE Firm," "Search Fund," "Strategic," or "Individual."

- Configure user permissions: Junior brokers shouldn't necessarily see the full firm-wide commission data.

Phase 2: Data Migration

- Clean existing data before import: Do not import 5,000 bad emails. Scrub your list.

- Map fields accurately: Ensure "Company Name" in your old Excel sheet matches "Account Name" in the CRM.

- Verify data integrity post-migration: Spot check 10 random contacts to ensure notes and attachments survived the move.

- Archive legacy system: Keep a read-only backup, just in case.

Phase 3: Adoption

- Start with core features only: Don't try to use the AI-buyer-matching on day one. Just log calls and emails.

- Use consistently from day one: "If it's not in the CRM, it didn't happen."

- Log all interactions: Every call, every text.

- Review weekly for optimization: Is a specific stage in your pipeline getting clogged? Adjust the workflow.

Common CRM Mistakes Business Brokers Make

Mistake | Consequence |

|---|---|

Over-customizing initially | You build a complex monster that no one understands, leading to slow adoption. |

Partial adoption | "I'll put the big deals in the CRM, but keep the small ones on my notepad." This destroys your data integrity. |

Ignoring mobile setup | If your team can't add a lead while at a networking event, they will lose that lead. |

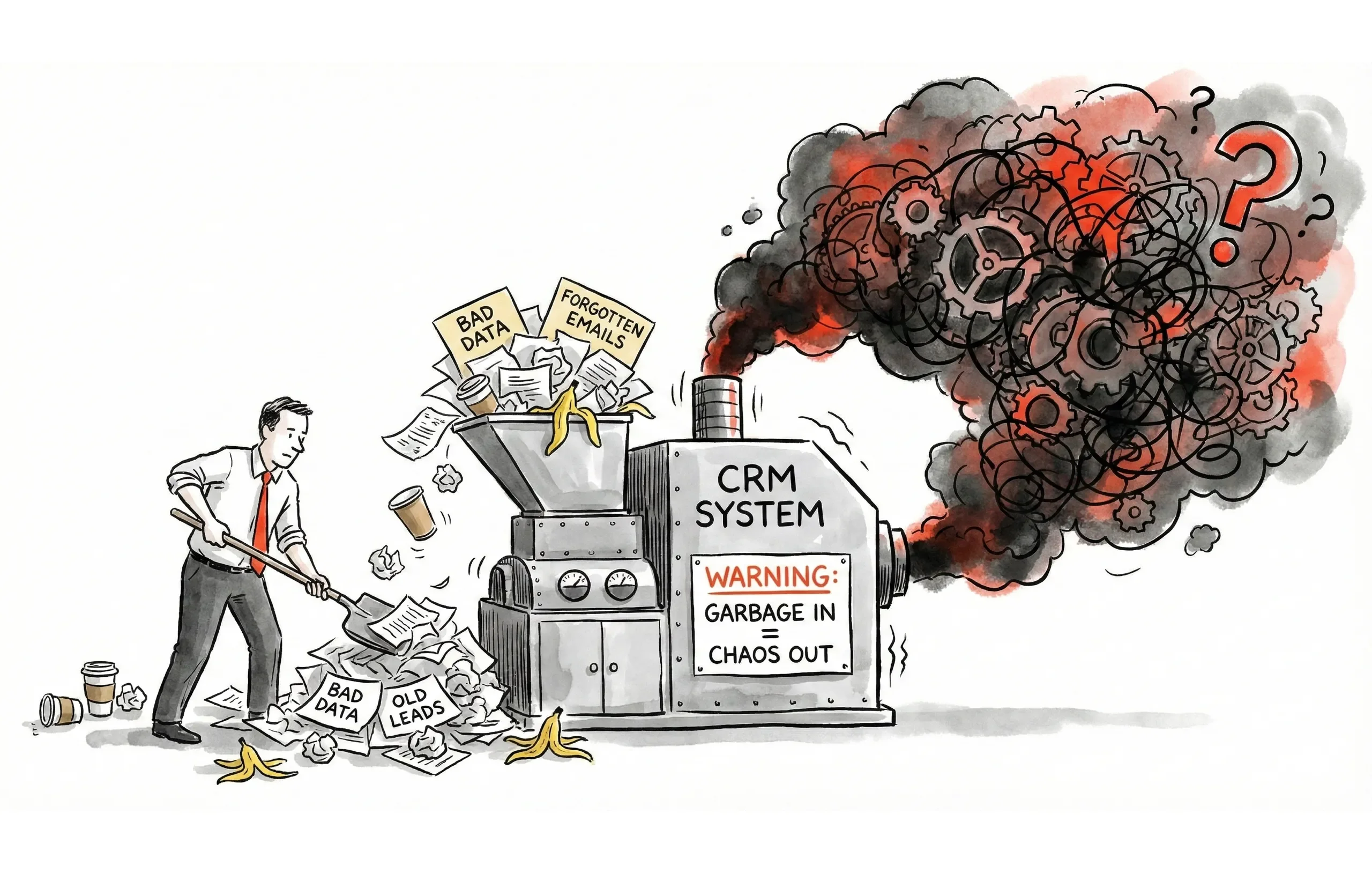

Skipping data cleanup | "Garbage in, garbage out." A messy database makes your buyer matching tools useless. |

No usage discipline | System abandonment. If leadership doesn't use it, no one will. |

Choosing the Right CRM for Your Business Brokerage

The right CRM for business brokers isn't the platform with the most features or the lowest price—it's the system your team will actually use every day to close more deals. Whether you choose an industry-specific platform like DealRelations or customize a general CRM like HubSpot, success depends on three factors:

- Match your workflow — The CRM should reflect how you actually work, not force you to change proven processes

- Start simple, scale smart — Implement core features first (contacts, deals, tasks) before activating advanced automation

- Commit to consistent usage — A basic CRM used religiously beats a sophisticated system used sporadically

Remember: up to 90% of business buyers never complete their transaction. Your CRM for business brokers is the competitive advantage that helps you identify, nurture, and close the 10% who are serious.

Ready to implement a CRM system? Start by requesting demos from 2–3 platforms that match your firm size, then use the evaluation framework above to test them with real deals.

![CIM Template for Business Brokers: Professional Format & Structure [2026]](https://d1pdxhu5fo8gl6.cloudfront.net/media/cim-template-business-broker_2025_Dec_1.webp)