We’ve all been there. You have a motivated seller, a qualified buyer with dry powder ready to deploy, and a signed LOI. The financials are clean, the "add-backs" are defensible, and you’re already mentally spending your commission check.

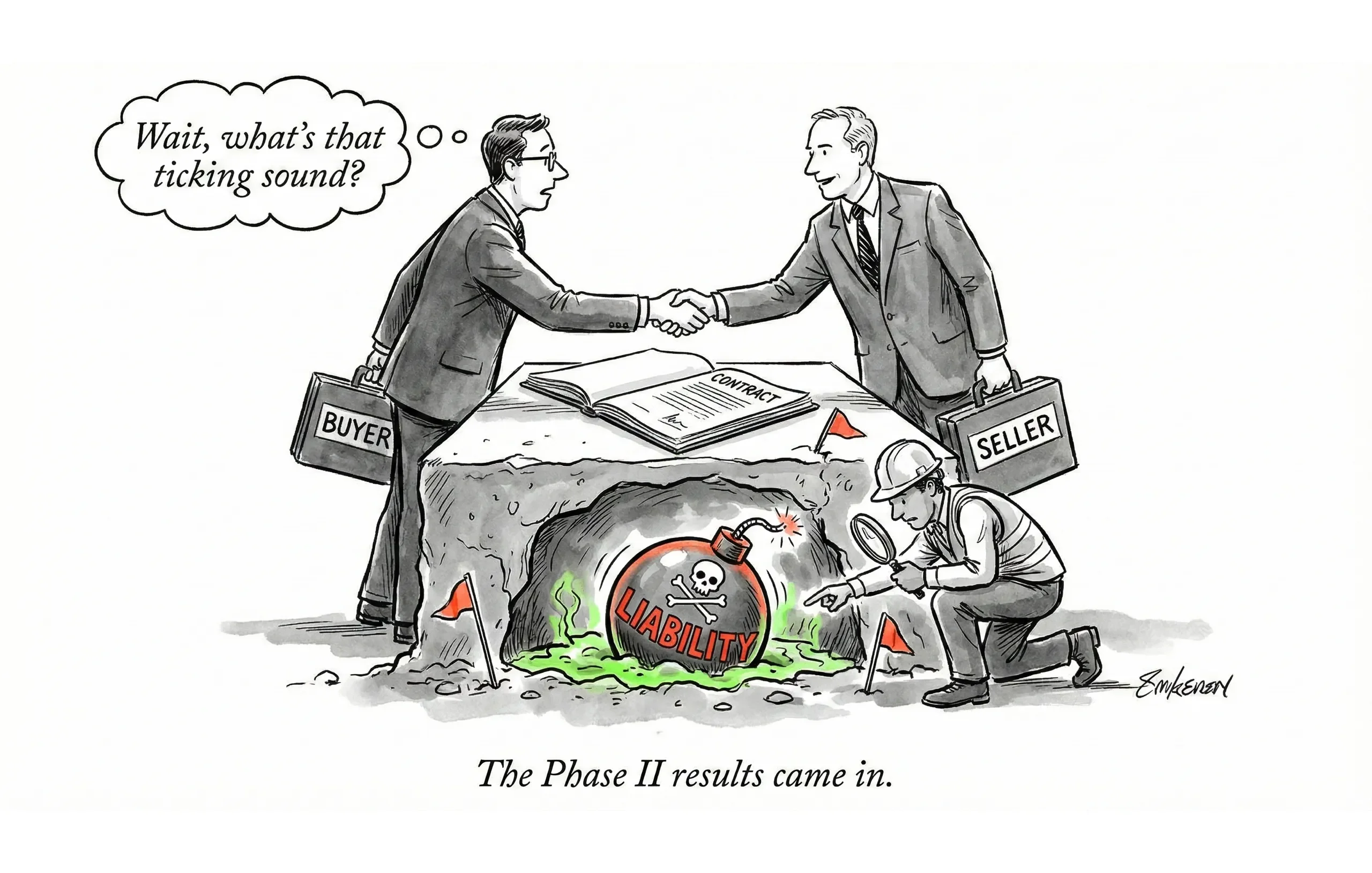

Then, the environmental report comes back.

Suddenly, that "turnkey" manufacturing facility isn't just a business opportunity; it’s a potential Superfund site because a dry cleaner operated next door in 1985. The buyer gets cold feet, the lender pulls back, and your deal is on life support.

Environmental due diligence (EDD) is the unsexy, often overlooked component of a transaction that has the power to kill deals faster than a bad Q4 earnings report. In fact, a recent Deloitte survey found that over 70% of companies have abandoned potential acquisitions due to environmental or ESG concerns.

For us as brokers, understanding EDD isn't about becoming environmental engineers. It's about spotting the "ticking time bombs" early enough to manage expectations and structure the deal around them.

The "Sniff Test": When is Environmental DD Needed?

Not every main street deal needs a Phase I ESA. You aren't going to demand soil samples for a mall kiosk or a SaaS company with no physical footprint. However, if real estate is changing hands—or if the business operations involve any hazardous materials—you need to be on high alert.

High-Risk Business Types

If you are brokering a deal in any of these sectors, assume environmental diligence is mandatory, not optional.

Business Type | Risk Factors |

|---|---|

Gas Stations | Underground storage tanks (USTs) are the #1 liability source. |

Auto Repair | Hydraulic lifts, oil/fluid disposal, and floor drains. |

Dry Cleaners | Perchloroethylene (PERC) contamination is notoriously difficult to remediate. |

Manufacturing | Chemical storage, metal plating, and industrial waste. |

Printing Shops | Historical use of solvents, inks, and heavy metals. |

Agriculture | Long-term pesticide and fertilizer runoff. |

Subtle Risk Indicators

Even outside of obvious industries, keep an eye out for these red flags during your initial walkthrough or CIM preparation:

- Vents or Fill Pipes: Random pipes sticking out of the ground often indicate old, forgotten fuel tanks.

- Stained Concrete: Dark staining near drains or loading docks.

- "Orphan" Drums: Unlabeled 55-gallon drums sitting behind a shed.

- Neighboring Properties: Is the subject property adjacent to a gas station or industrial site? Migration of groundwater contamination is a real liability.

Phase I Environmental Site Assessment (ESA)

Think of the Phase I ESA as the "Background Check" of the property. It involves no physical testing (no drilling, no dirt). It is purely research-based.

Why it matters: A clean Phase I is the golden ticket for the "Innocent Landowner Defense" under CERCLA (Superfund) liability. Without it, your buyer purchases the pollution along with the property.

What It Includes

Component | Description |

|---|---|

Site Inspection | A visual walk-through to spot stressed vegetation, tanks, or stains. |

Historical Review | Analyzing aerial photos and fire insurance maps dating back decades. |

Records Search | Reviewing state and federal regulatory databases for reported spills. |

Interviews | Talking to past owners and occupants about historical use. |

Cost and Timeline (2024/2025 Estimates)

Prices have ticked up recently due to inflation and tighter ASTM standards.

Factor | Typical Range |

|---|---|

Cost | $2,000 - $5,000 (Commercial) |

Duration | 2-4 weeks (Rush options usually available for a fee) |

Validity | 180 days (Must be updated if the deal drags on) |

Source: Aegis Environmental 2025 Cost Guide

Decoding the Findings

When the report lands on your desk, you're looking for one acronym: REC (Recognized Environmental Condition).

- No RECs: Green light. Proceed to closing.

- REC Identified: Yellow/Red light. The consultant found something suspicious (e.g., "historical use of solvents"). This usually triggers a Phase II.

Phase II Assessment: Digging Deeper

If the Phase I is the background check, the Phase II is the interrogation. This is where the deal often stalls, so you need to manage "deal fatigue" carefully here.

When is it triggered? When a Phase I identifies a REC that cannot be explained away by paperwork.

What It Includes

- Subsurface Sampling: Drilling borings to collect soil and groundwater samples.

- Lab Analysis: Testing for specific contaminants (petroleum, heavy metals, VOCs).

- Vapor Intrusion: Testing indoor air quality to ensure fumes aren't seeping up through the foundation.

The "Deal Killer" Potential

Factor | Typical Range |

|---|---|

Cost | $5,000 - $50,000+ (Highly variable based on scope) |

Duration | 4-8 weeks (Lab turnaround times can vary) |

Pro Tip: Who pays for this? Typically, the buyer pays for the Phase I. If a Phase II is required, costs are often negotiated. A confident seller with nothing to hide might split it; a seller who knows there are skeletons in the closet might refuse (which is a red flag in itself).

Protecting Against Liability (Saving the Deal)

So, the Phase II came back "hot." You found contamination. Is the deal dead? Not necessarily.

Experienced brokers know that environmental issues are just another financial variable to be modeled. Here is how we structure around the mess:

1. The "Innocent Landowner" Defense

Ensuring the Phase I was done according to ASTM E1527-21 standards allows the buyer to claim they did "All Appropriate Inquiries." This limits their liability for pre-existing contamination.

2. Indemnification & Escrow

If the cleanup cost is estimated at $100,000, you might hold back $150,000 of the purchase price in escrow to cover it. The seller indemnifies the buyer for anything exceeding that amount. This keeps the buyer safe and allows the seller to exit, albeit with a smaller check.

3. Environmental Insurance

For larger deals, "Pollution Legal Liability" (PLL) insurance can cap the exposure. It’s expensive but can salvage a multi-million dollar transaction that has a "dirty" history.

4. Asset vs. Stock Purchase

This is a classic legal distinction.

- Stock Sale: Buyer usually inherits all environmental liabilities (past, present, and future).

- Asset Sale: Buyer can often purchase the clean assets and leave the liability with the seller entity (though strict laws can sometimes pierce this veil).

Common Nightmares: What to Watch For in Environmental Diligence

Underground Storage Tanks (USTs)

The classic headache. If a tank leaks, it doesn't just soil the dirt; it hits the groundwater. The EPA estimates the average cleanup cost for a UST leak is roughly $125,000, but complex cases can easily exceed $1 million.

Asbestos and Lead

Common in pre-1978 buildings. These aren't usually deal killers, but they are "price chippers." Buyers will use the cost of abatement to grind down the purchase price.

"Tire Kickers" vs. Serious Buyers

A serious buyer will view environmental issues as a risk to be quantified. A "tire kicker" will use a REC as an excuse to walk away. Use the environmental objection to gauge the buyer's true intent.

The Bottom Line for Brokers

Environmental Due Diligence is risk management, plain and simple. Your role isn't to fix the leak, but to ensure your client—whether buyer or seller—isn't blindsided by it.

By bringing these discussions up early (even pre-LOI), you position yourself not just as a broker, but as a strategic advisor who sees the potholes before the car hits them.

![CIM Template for Business Brokers: Professional Format & Structure [2026]](https://d1pdxhu5fo8gl6.cloudfront.net/media/cim-template-business-broker_2025_Dec_1.webp)