We’ve all been there. You have a motivated seller, a buyer with plenty of "dry powder," and an LOI that was signed with champagne toasts. The financials are clean, and the SDE (Seller's Discretionary Earnings) looks fantastic. You’re already mentally spending that commission check.

Then, the lawyers get involved.

Suddenly, a "perfect" deal grinds to a halt because of a single sentence in a vendor contract or a missing signature on an IP assignment from three years ago. It’s the stuff of broker nightmares.

Legal due diligence identifies contractual obligations, potential liabilities, and legal risks that could affect the transaction or future business operations. Considering that estimates suggest up to 67% of business sales fail during the due diligence phase, getting these documents right isn't just "admin work"—it's deal protection.

Core Due Diligence Docs for SMB Acquisition

Before we get into the weeds of contracts, we have to verify the vehicle itself. If the entity isn't solid, you’re selling a car with no VIN.

Formation and Governance

A common friction point arises when a "mom and pop" seller has been operating loosely for decades. You need to ensure the entity is actually in Good Standing. If they missed a state filing two years ago, you can't close until it's fixed.

Document | Purpose |

|---|---|

Articles of Incorporation/Organization | Entity establishment |

Bylaws or Operating Agreement | Governance rules |

Amendments | Changes to structure |

Good standing certificates | Current status |

Stock certificates/membership interests | Ownership verification |

Board/member resolutions | Decision authority |

Ownership Verification

This is where you find the "silent partner" or the ex-spouse who technically still owns 5%.

- Ownership percentages

- Rights and obligations of owners

- Transfer restrictions

- Approval requirements for sale

Contract Review

This is usually where the "deal killers" hide. The most dangerous phrase in M&A isn't "revenue decline"—it's "Anti-Assignment."

Customer Contracts

If a business relies on three major clients, and those contracts have strict "Change of Control" clauses that allow the client to walk away upon sale, your buyer is buying an empty shell. According to the IACCM, poor contract management can cost a company up to 9% of its annual revenue, but in a sale, it can cost you the whole deal.

Review Area | Focus |

|---|---|

Term and renewal | Revenue continuity |

Termination provisions | Risk of loss |

Assignment clauses | Transferability |

Pricing commitments | Margin protection |

Service obligations | Operational requirements |

Non-compete provisions | Customer restrictions |

Vendor Contracts

Don't let a "tire kicker" buyer get spooked because a critical supply agreement expires next month.

Review Area | Focus |

|---|---|

Supply agreements | Critical suppliers |

Pricing and terms | Cost structure |

Exclusivity provisions | Limitations |

Assignment clauses | Transferability |

Termination terms | Supply continuity |

Lease Agreement

We all know landlords can be the unofficial "third party" in any deal. If there are no renewal options left or the assignment fee is exorbitant, you need to know now.

Review Area | Focus |

|---|---|

Remaining term | Facility security |

Renewal options | Future flexibility |

Rent and escalations | Cost projections |

Assignment/sublease | Transfer rights |

Personal guarantee | Buyer obligations |

Use restrictions | Operations limitations |

Employment Matters

Labor issues are exploding in the SMB space. A report by Counterpart found that 37% of small businesses have faced an employee lawsuit in the last year. Buyers are terrified of inheriting a wage-and-hour claim.

Employment Documents

Reviewing these documents protects the buyer from "add-backs" that aren't actually legitimate, like underpaid commissions.

Document | Purpose |

|---|---|

Employment agreements | Key employee terms |

Non-compete agreements | Competitive protection |

Confidentiality agreements | IP protection |

Commission/bonus plans | Compensation obligations |

Employee handbook | Policy compliance |

HR Compliance

Intellectual Property for SMB Acquisitions

For tech-enabled businesses, this is the whole asset. If a freelance developer wrote the code five years ago and never signed an IP assignment agreement, the seller doesn't own their product.

IP Documentation

IP Type | Documents Needed |

|---|---|

Trademarks | Registrations, applications |

Patents | Grants, pending applications |

Copyrights | Registrations |

Trade secrets | Protection policies |

Domain names | Registration records |

Software | Licenses, ownership |

IP Considerations

Licenses and Permits

You can't sell a restaurant if the liquor license doesn't transfer. This is a binary risk—either you have the license, or you don't operate.

Business Licenses

Category | Examples |

|---|---|

General business | Business license, DBA |

Industry-specific | Contractor, professional, health |

Regulatory | EPA, OSHA, FDA |

Local permits | Zoning, signage, health |

Transferability Assessment

- Which licenses transfer automatically?

- Which require re-application?

- Timeline for new licenses?

- Any licensing issues or violations?

Litigation and Claims

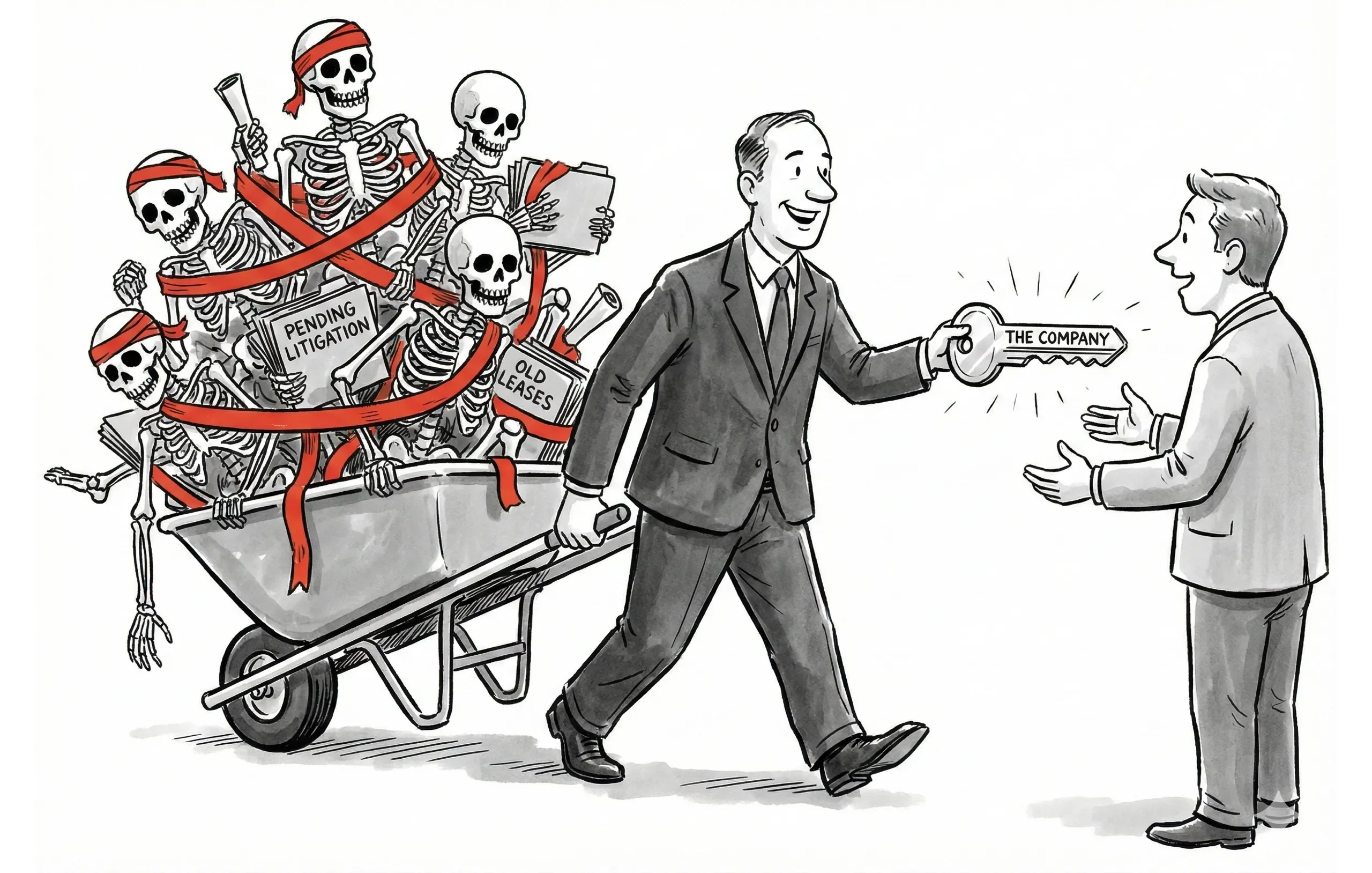

Skeletons in the closet are expensive. The U.S. Chamber of Commerce notes that legal liabilities are seven times greater for small businesses (relative to revenue) than larger ones.

Current Matters

Historical Matters

Insurance Review

Buyers need to know if the business is insurable post-close. This is also where you discuss "Tail Coverage" for D&O (Directors and Officers) liabilities.

Current Coverage

Type | Review Points |

|---|---|

General liability | Coverage limits, claims history |

Property | Asset coverage, deductibles |

Workers' comp | Claims experience, rating |

Professional liability | E&O coverage |

Auto | Fleet coverage |

D&O | Director/officer protection |

Claims History

- Past claims and outcomes

- Current open claims

- Insurance availability post-close

Red Flags for Small Business Acquisitions

If you spot these early, you can sometimes fix them. If you find them a week before closing, the deal is dead.

Legal Red Flags

Red Flag | Concern |

|---|---|

Pending litigation | Financial liability |

Non-transferable key contracts | Revenue risk |

Lease expiring soon | Facility uncertainty |

License violations | Operating risk |

IP ownership unclear | Asset questions |

Employment disputes | HR liabilities |

![CIM Template for Business Brokers: Professional Format & Structure [2026]](https://d1pdxhu5fo8gl6.cloudfront.net/media/cim-template-business-broker_2025_Dec_1.webp)