Here's the truth: understanding the different types of business buyers is the single most important skill that separates brokers who close deals at premium multiples from those who watch listings go stale.

You've been there. Perfect listing. Strong TTM revenue. Clean SDE. Solid add-backs. You blast the teaser, get interest from a PE firm, send the CIM, hop on the intro call, and... nothing. Or worse, they grind your multiple down until your seller feels insulted and walks.

The problem? You're pitching the wrong deal structure to the wrong buyer type.

When you truly understand the two primary types of business buyers—Strategic and Financial—you stop wasting time on mismatched conversations and start engineering deals that close. This guide breaks down the psychology, motivations, and pitch strategies for each business buyer category so you can qualify faster and close cleaner.

Why Knowing Your Business Buyer Categories Matters

Most brokers obsess over finding buyers but spend zero time diagnosing them. That's backwards.

According to Morgan Stanley's research on buyer behavior, the mismatch between buyer motivation and deal presentation is the #1 reason transactions fail during LOI negotiation. Financial buyers walk away from growth stories they can't model. Strategic buyers pass on "stable cash flow" businesses that don't move their competitive needle.

The fix? Develop a systematic approach to identifying and qualifying business buyers based on their acquisition DNA.

Let's break down the two main types of business buyers, what drives their decision-making, and how to structure your pitch for each.

Type 1: Financial Buyers—The Cash Flow Engineers

Financial buyers are in the business of manufacturing returns from capital deployment. This category includes Private Equity firms, Family Offices, Search Funds, and High-Net-Worth Individuals looking for investment-grade acquisitions.

What Financial Buyers Actually Want

These buyer types are purchasing a standalone investment vehicle designed to generate measurable financial returns within a defined timeline.

Their Core Metrics:

- IRR (Internal Rate of Return): Typically targeting 20-30% over a 3-7 year hold period

- Cash-on-Cash Returns: How quickly debt can be paid down using the business's own EBITDA

- Exit Multiple Expansion: Buying at 4x EBITDA, improving operations, selling at 6x EBITDA

- Platform Potential: Can this business serve as a foundation for rolling up competitors?

The Language They Speak:

- "What's your dry powder allocation for lower middle-market deals?"

- "Is this a platform play or a bolt-on opportunity?"

- "Walk me through your Quality of Earnings assumptions."

- "What's the management retention package look like?"

The Broker's Reality: Financial Buyers Are Professional Skeptics

Financial buyers review 100+ deals to close one. They have fiduciary responsibility to Limited Partners (LPs) with strict investment mandates. If your deal doesn't hit their EBITDA floor ($1M+ for most lower-middle-market PE shops) or fit their sector thesis, no amount of relationship-building changes their answer.

According to Harvard Business Review's analysis of private equity value creation, PE firms generate returns primarily through operational improvements and financial engineering—not through the synergies that strategic buyers can realize. This means your financials must be bulletproof.

"Financial buyers are notoriously disciplined. They have a specific mandate from their Limited Partners. If your deal doesn't fit their EBITDA floor or their industry thesis, no amount of salesmanship will change their mind." — Morgan Stanley

How to Pitch Financial Buyers (The Winning Formula)

1. Lead with Clean, Conservative Financials

Your add-backs need to survive scrutiny from a 26-year-old associate with a finance degree and something to prove. If you're adding back the owner's boat lease or "marketing expenses we probably didn't need," expect those to get rejected during Quality of Earnings review.

Conservative add-backs that work:

- Owner salary above market rate (with comps to support "market rate")

- One-time legal fees or equipment purchases

- Above-market rent to a related party (if you can prove FMV)

2. Highlight the Management Team (or Lack Thereof)

Unless this is a bolt-on acquisition (where they're folding your client's business into an existing portfolio company), PE buyers need a strong #2 or #3 who can run operations post-close. The owner can't be the only person who knows how anything works.

Frame it like this: "The current GM has been running day-to-day for 3 years. Owner works 10 hours/week on strategic relationships. Fully transferable under standard earnout structure."

3. Position the Platform Opportunity

If the industry is fragmented (tons of small competitors, no dominant player), financial buyers see roll-up potential. Show them the TAM (Total Addressable Market), the pipeline of potential bolt-ons, and how acquiring your client's business gives them the platform to execute a buy-and-build strategy.

Sample positioning: "This is the 3rd-largest player in a $400M regional market with 200+ sub-$2M competitors. Perfect platform for a programmatic roll-up with immediate cost synergies on back-office consolidation."

Type 2: Strategic Buyers—The Synergy Hunters

Strategic buyers are operating companies looking to integrate an acquisition into their existing business infrastructure. They're often competitors, suppliers, customers, or companies in adjacent verticals.

What Strategic Buyers Actually Want

Strategic buyer types aren't just buying cash flow—they're buying competitive advantage. They want 2 + 2 to equal 5 through operational synergies, market expansion, or defensive acquisitions.

Their Core Motivations:

- Eliminate a Competitor: Remove pricing pressure and consolidate market share

- Acquire Proprietary Technology/IP: Faster and cheaper than building in-house

- Geographic Expansion: Instant presence in a new region with established relationships

- Customer List Arbitrage: Cross-sell existing products to the acquired customer base

- Vertical Integration: Control more of the supply chain (upstream or downstream)

The Language They Speak:

- "What's the overlap in our customer bases?"

- "How much cost can we strip out through back-office consolidation?"

- "What's the retention risk if we integrate this under our brand?"

- "Do they have any proprietary processes or relationships we can't replicate?"

The Broker's Reality: Strategic Buyers Pay Premiums (But Move Slowly)

This is where premium pricing lives. Because strategic buyers can eliminate redundant costs post-acquisition—think dual accounting teams, overlapping sales territories, redundant software licenses—the business is functionally worth more to them than to a financial buyer.

Research from Divestopedia shows that strategic buyers consistently pay 20-40% more than financial buyers for the same business because they can realize immediate value through synergies.

"Strategic buyers generally pay more than financial buyers because they can realize synergies that financial buyers cannot." — Divestopedia

The trade-off? Strategic deals move slower. Corporate bureaucracy, board approvals, integration planning, cultural fit assessments—all of this extends timelines.

How to Pitch Strategic Buyers (The Synergy Playbook)

1. Focus on "Fit" Over Financials

Don't lead with the EBITDA multiple. Lead with how this acquisition solves a strategic problem they're already trying to solve.

Bad opening: "This business does $2M in EBITDA at a 4.5x multiple."

Good opening: "You're spending $500K/year trying to break into the Houston market. This acquisition gives you 8 years of established relationships, 200 active customers, and a local team—delivered in 90 days instead of 3 years."

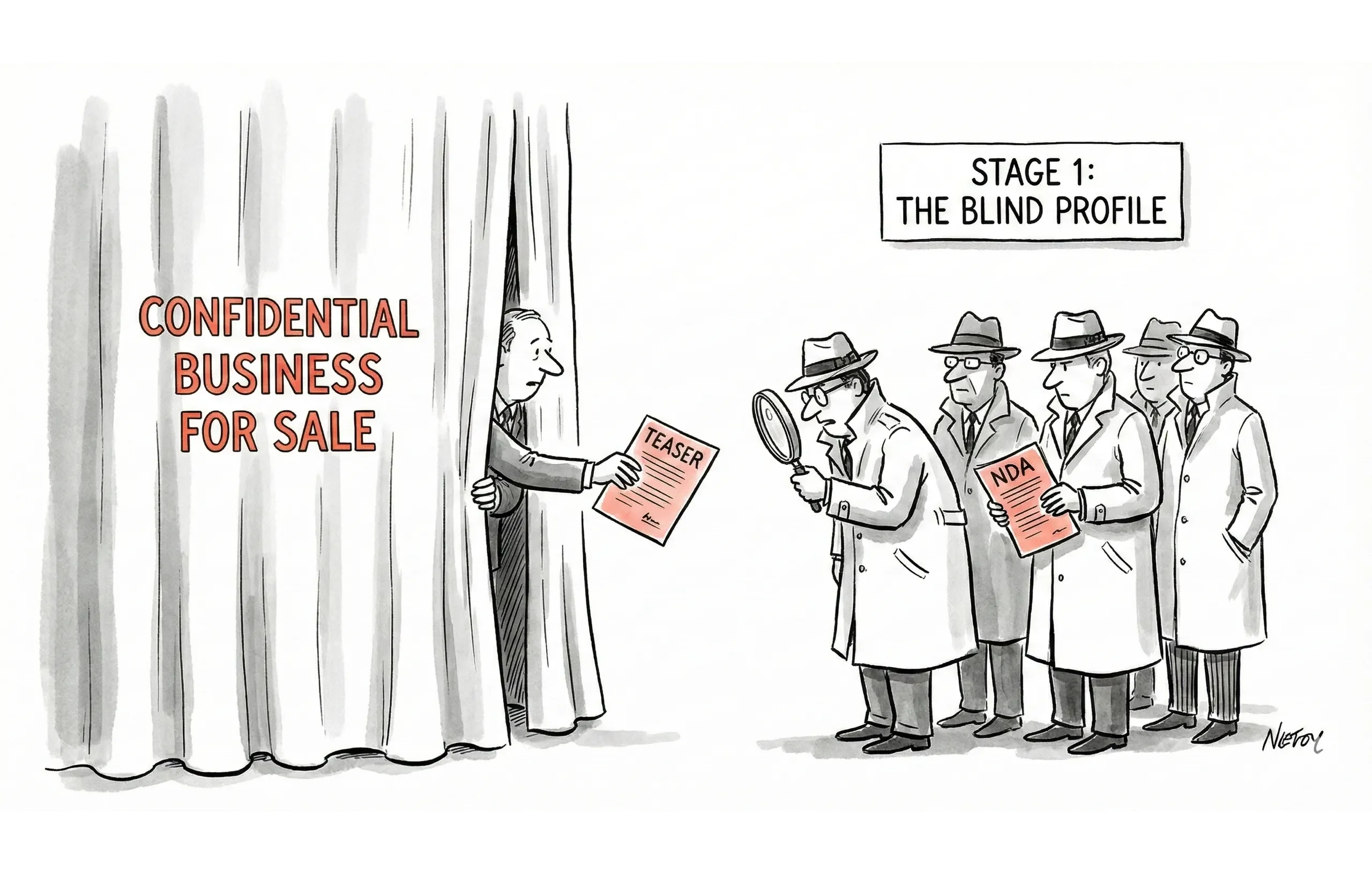

2. Protect Confidentiality Like Your License Depends On It (Because It Does)

You're often disclosing sensitive information to a direct competitor. One slip—one premature reveal of customer names or pricing strategies—and you've torpedoed your client's business even if the deal falls apart.

Best practices:

- Use ironclad NDAs with specific carve-outs for what can't be shared with sales teams

- Release information in stages (high-level teaser → blind CIM → identified CIM → data room)

- Never reveal "secret sauce" (proprietary processes, key relationships, pricing models) until you're past LOI with hard deposits

3. Get Aggressive with Add-Backs (Strategically)

If the buyer has their own CFO, Controller, HR Manager, and IT infrastructure, you can justify adding back those costs because they disappear on Day 1 post-close.

This is where you can sometimes justify adding back 30-40% more than you could with a financial buyer, which directly inflates the valuation.

Example conversation: "Your CFO is already handling $50M in revenue. Adding this $8M division doesn't require a separate $120K/year controller. That's pure cost synergy we're pricing into the multiple."

The Hybrid Types of Business Buyers (Where Categories Blur)

The business buyer landscape isn't always clean. Here are the hybrid types that combine characteristics:

Family Offices

They underwrite like financial buyers (strict EBITDA requirements, ROI modeling) but behave like strategic buyers with patient capital. No forced 5-year exit timeline means they'll pay for quality and hold long-term.

How to pitch them: Emphasize stability, generational value, and alignment with their existing portfolio (if they have operating companies, position synergies).

PE-Backed Strategic Buyers

A portfolio company owned by a PE firm that's executing a buy-and-build strategy. They talk like strategic buyers ("synergies," "market consolidation") but crunch numbers like financial buyers (strict IRR hurdles, leverage models).

How to pitch them: Combine both playbooks. Lead with synergy, back it up with bulletproof financials.

Summary: How to Qualify and Pitch Each Type of Business Buyer

Here's your decision matrix for qualifying business buyers and tailoring your pitch:

Feature | Financial Buyers | Strategic Buyers |

|---|---|---|

Primary Goal | ROI / IRR Targets | Competitive Advantage |

Valuation Driver | EBITDA Multiples | Synergistic Value |

Speed to Close | Medium (3-6 months) | Slow (6-12 months) |

Due Diligence Focus | Quality of Earnings | Cultural Fit / Integration |

Owner's Post-Close Role | Usually stays (2-3 years) | Usually exits immediately |

Deal Breaker | Unverifiable add-backs | Customer/employee retention risk |

Typical Premium | 3.5-5.5x EBITDA | 5.0-7.5x EBITDA |

Action Plan: Stop Mismatching Buyer Types to Your Listings

Here's what to do right now with your active listings:

Step 1: Audit Your Stalled Deals

Pull up every listing that's been on the market 90+ days without an LOI. Ask yourself: "Am I pitching a synergy story to spreadsheet buyers, or a cash flow story to empire builders?"

Step 2: Segment Your Buyer Database

Go into your CRM right now and create two tags: "Financial Buyer" and "Strategic Buyer." Go through your contact list and categorize every qualified buyer. Add notes about their specific mandates (PE: $1M+ EBITDA, Tech sector | Strategic: Regional HVAC consolidation play).

Step 3: Rewrite Your Teasers for Each Buyer Category

Create two versions of every blind teaser:

- Financial Buyer Version: Lead with EBITDA, revenue growth, management depth, and platform potential. Use conservative add-backs. Highlight recurring revenue and customer concentration (or lack thereof).

- Strategic Buyer Version: Lead with market position, proprietary advantages, customer overlap opportunities, and cost synergies. Be more aggressive with add-backs. Emphasize how acquisition is faster/cheaper than organic growth.

Step 4: Pre-Qualify Using Buyer-Specific Questions

Before you send a CIM, get on a 15-minute call and ask qualifier questions based on buyer type:

For Financial Buyers:

- "What's your EBITDA floor for platform investments?"

- "What's your typical hold period and exit strategy?"

- "Do you have existing portfolio companies in this sector?"

For Strategic Buyers:

- "What specific problem does this acquisition solve that you can't build internally?"

- "What's your integration playbook—rebrand or operate independently?"

- "How do you typically structure earnouts for founder retention?"

The Bottom Line: Master Business Buyer Types to Close Better Deals

Understanding the types of business buyers isn't just "nice to know"—it's the fundamental skill that determines whether you're a broker who moves inventory or one who engineers premium exits.

Financial buyers want cash flow they can model, leverage, and exit. Strategic buyers want competitive advantages they can integrate and scale. Hybrid buyers want some combination based on their unique mandate.

Stop spraying and praying. Start diagnosing and targeting.

When you match the right buyer type to the right opportunity with the right pitch structure, three things happen:

- You close faster (less time wasted on misaligned conversations)

- You close at higher multiples (buyers pay more when the fit is obvious)

- You build a reputation (sellers and buyers both refer you more deals)

Now go back through your pipeline and ask yourself: "Am I talking to the right types of business buyers, or am I just talking to anyone who'll listen?"

The deals you close in the next 90 days will give you the answer.