You know the feeling. You’ve got a solid listing, a motivated seller, and a buyer with financing lined up. The CIM went out, the LOI was signed, and everyone is popping champagne (mentally, at least).

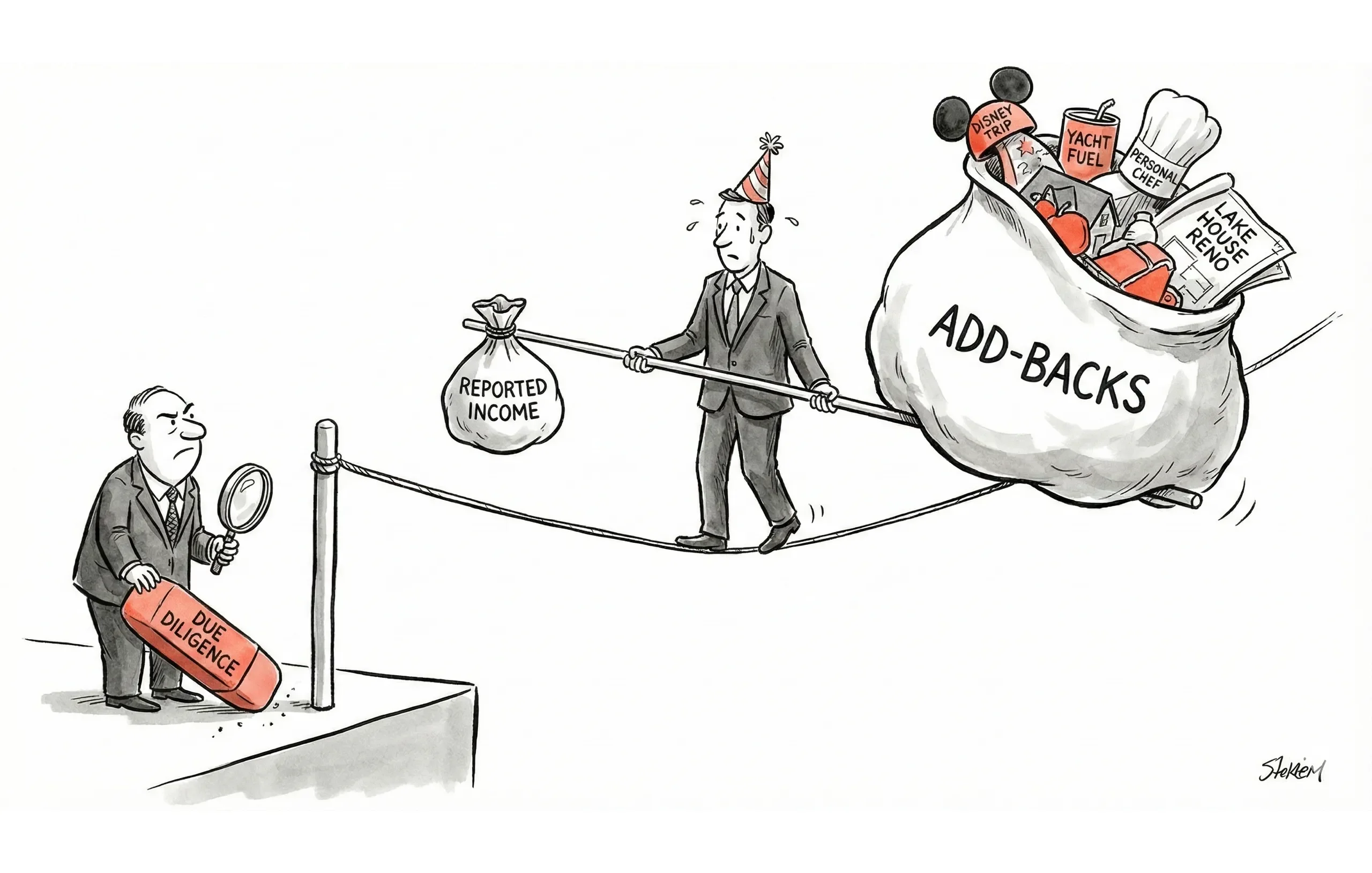

Then comes due diligence.

Suddenly, the buyer’s accountant flags a $45,000 "marketing trip" that looks suspiciously like a family vacation to Disney World. They find a "repair" expense that was actually a bathroom remodel at the owner’s lake house. The buyer’s trust evaporates. They start questioning everything. The deal wobbles, and you’re left scrambling to save it.

This isn't just a nightmare scenario; it's a statistical reality. According to recent industry data, approximately 50% of business sales fall apart during due diligence, with "poor financials" and "unrealistic seller expectations" consistently ranking as top deal killers [1] [2].

The culprit is often the add-back.

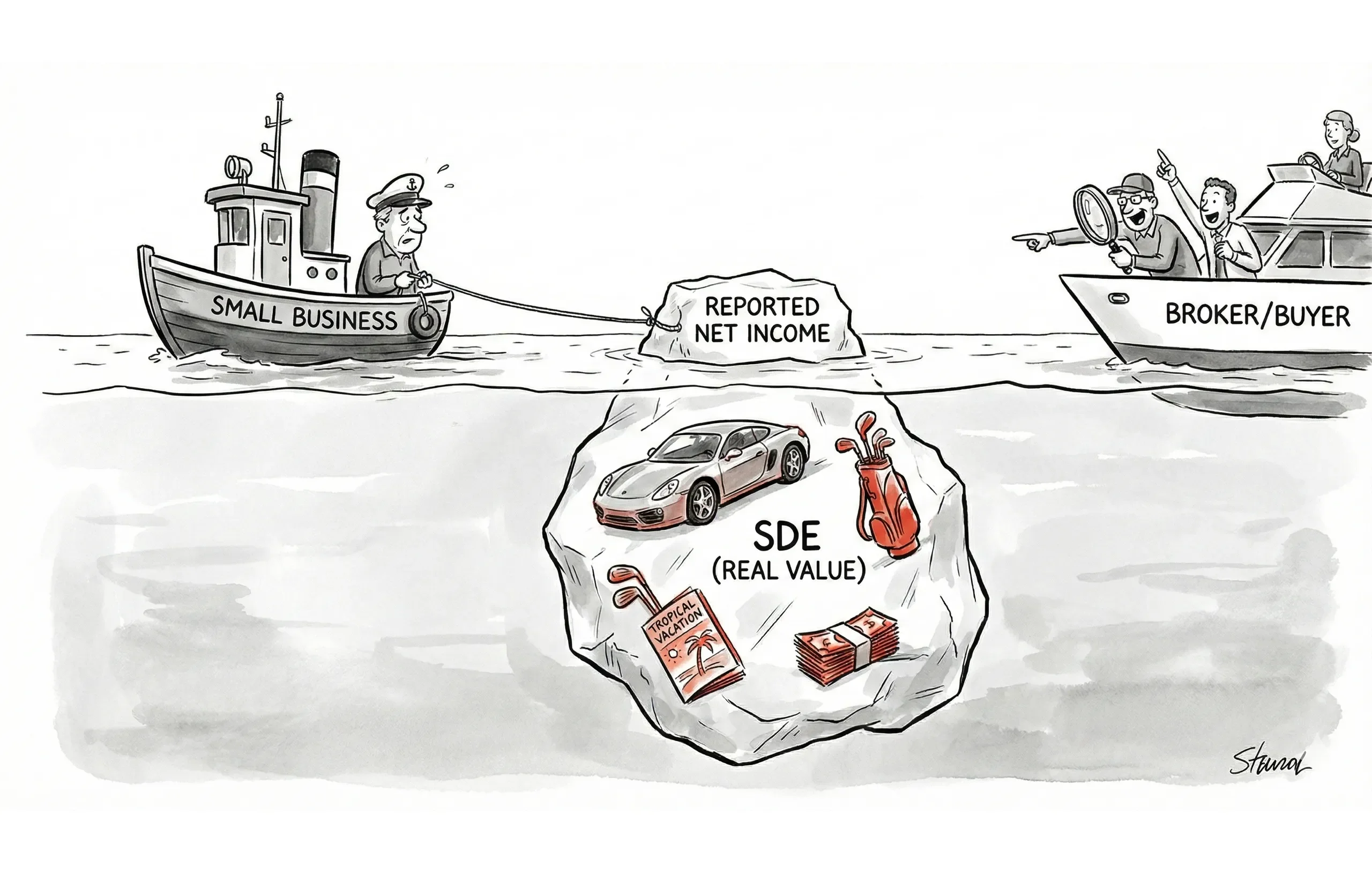

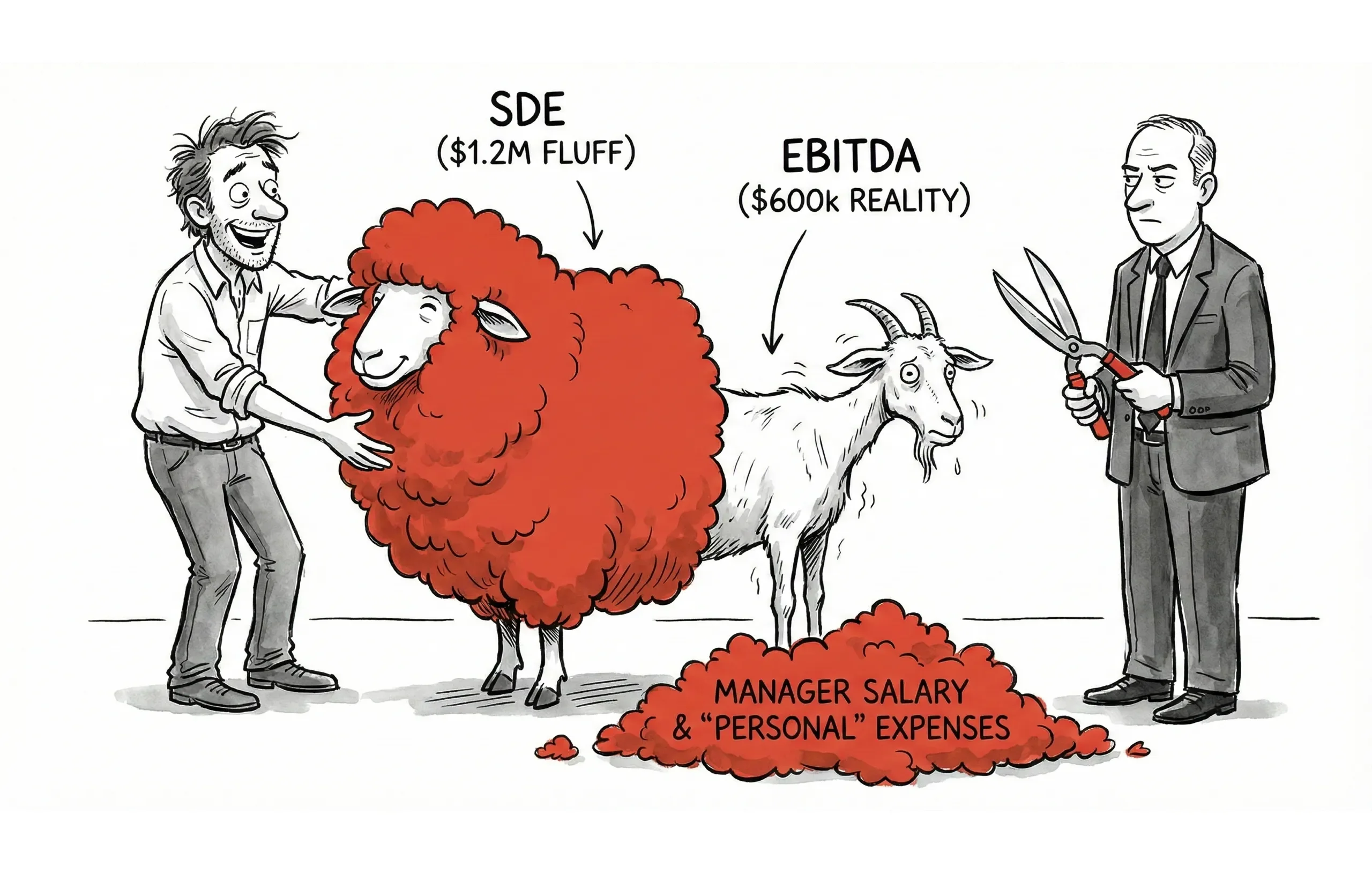

Add-backs are the double-edged sword of business valuation. Done right, they reveal the true economic power of a business (Seller’s Discretionary Earnings, or SDE). Done wrong, they destroy credibility faster than you can say "EBITDA."

Related: Small Business Valuation Methods: The Complete Guide

The Golden Rule of Add-Backs

Before we dive into the line items, let’s establish the "sniff test." An add-back is valid only if:

- It is a real cash expense.

- It will NOT be incurred by the new owner.

- It is documented.

If you can't prove it, you can't add it back. As Warren Buffett famously quipped about creative accounting, "References to EBITDA make us shudder" [3]. While he was talking about public companies, the sentiment applies to Main Street: buyers hate feeling like they're being sold "fake" earnings.

Categories of Add-Backs

1. Owner's Compensation

This is usually your biggest bucket. The goal of SDE is to show the total financial benefit available to a single full-time owner-operator.

Always add back:

- Owner's W-2 Salary: The full gross amount.

- Payroll Taxes: Only the employer portion associated with the owner's salary.

- Benefits: Health, dental, and vision insurance premiums paid by the company for the owner and their family.

- Retirement: 401(k) matching or profit-sharing contributions specifically for the owner.

The "Catch": If there are two owners working full-time and the buyer only plans to replace one, you cannot add back both salaries. You must leave enough expense in the P&L to pay a market-rate manager to replace the second owner.

2. Owner's Personal Expenses

This is where the "grey area" disputes happen. Sellers often run personal life through the business to minimize taxes. That's their prerogative, but it requires a paper trail to be a valid add-back.

Common valid add-backs:

Expense | Typical Range | Documentation Required |

|---|---|---|

Vehicle | $8k - $20k/yr | Mileage log, lease agreement, registration. |

Cell Phone | $1.2k - $2.4k/yr | Bills highlighting personal lines vs. business lines. |

Travel | Varies | Calendar entries proving the trip was personal (not client visits). |

Meals/Ent. | $3k - $10k/yr | Receipts. "Sunday brunch with family" counts; "Tuesday lunch with client" does not. |

Home Office | Varies | If the business has a physical HQ, home office rent is usually an add-back. |

Personal Ins. | Varies | Life or disability policies that benefit the owner's family, not the business key-man policy. |

3. Non-Cash Expenses

These are standard accounting adjustments.

- Depreciation & Amortization: These are accounting constructs to spread out the cost of assets. Since they aren't current cash outflows, we add them back.

- Note: Buyers will counter this by arguing for a "CapEx reserve" (more on that below).

4. Interest Expense

Add back: All interest payments (loans, credit cards, lines of credit).Rationale: The seller's debt is not the buyer's problem. The business is typically sold "debt-free," meaning the seller pays off their loans at closing. The buyer will have their own debt structure.

5. One-Time/Non-Recurring Expenses

These are the "freak events." If it won't happen again, the buyer shouldn't be penalized for it in the valuation.

Examples:

- Lawsuit Settlement: A one-off employment dispute.

- Natural Disaster Repairs: Fixing the roof after a 100-year storm (covered by insurance? verify the net cost).

- Consulting Fees: Paying a firm $50k to implement a new ERP system (a one-time upgrade).

- Bad Debt: A major client went bankrupt. (Only if this is truly an anomaly, not a regular cost of doing business).

6. Discretionary/Above-Market Expenses

Is the seller paying their nephew $80,000 to sweep the floors? That's an add-back (or at least the difference between $80k and the $30k market rate for a janitor).

- Rent: If the seller owns the building and pays themselves above-market rent, add back the excess.

What NOT to Add Back (The "Deal Killers")

This is where you save the deal before it even hits the market. Be the bad guy now so the buyer doesn't have to be later.

1. "Hidden" Cash

The Scenario: Seller says, "I take $50k in cash out of the register every year that isn't on the books."The Verdict: DO NOT ADD BACK.If it's not reported to the IRS, it doesn't exist. Adding this creates legal liability and implies tax fraud. It instantly spooks sophisticated buyers and lenders.

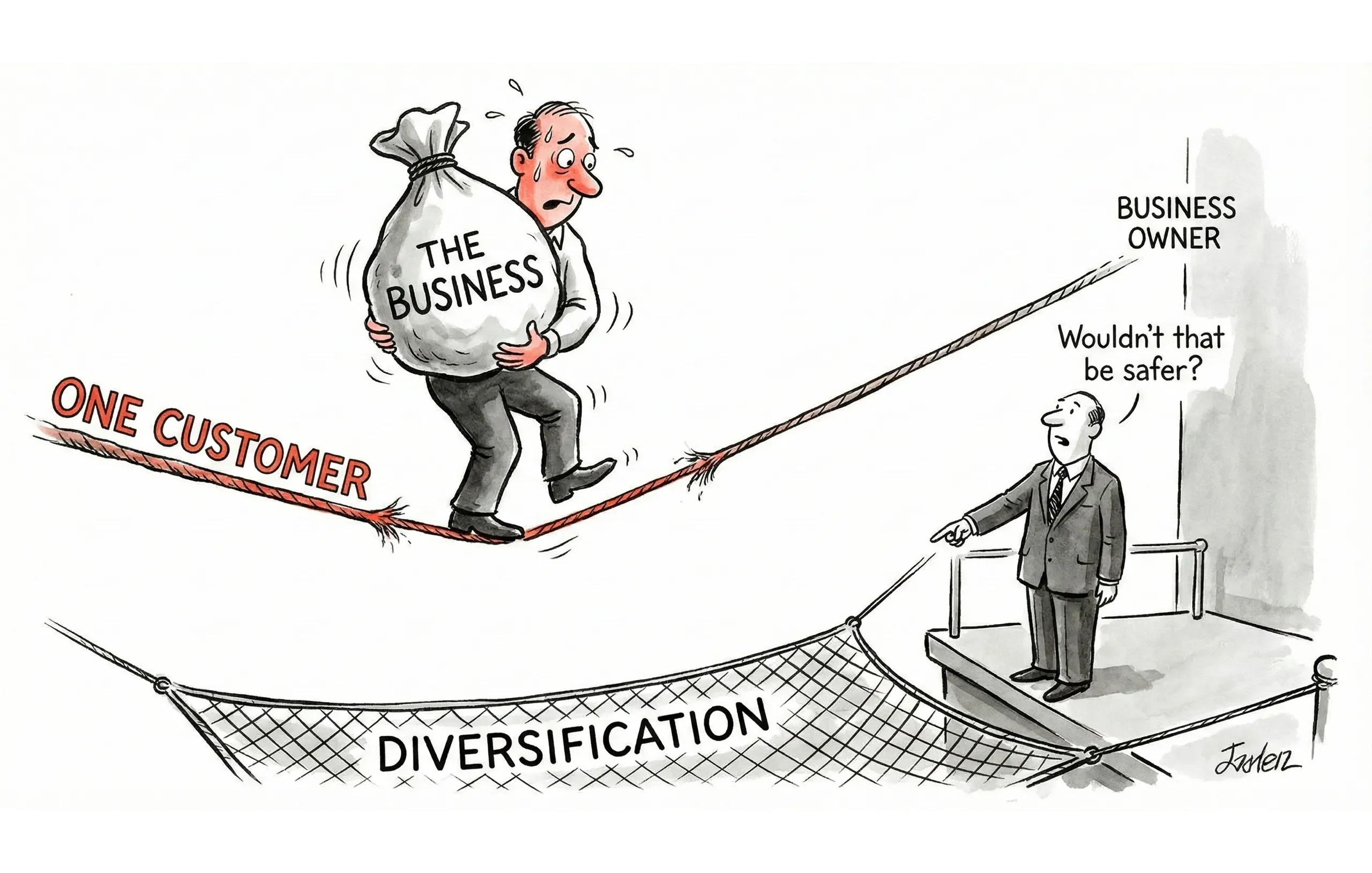

2. Required Capital Expenditures (CapEx)

You added back the $50,000 depreciation on the fleet of delivery trucks. Great. But those trucks are 15 years old and falling apart. The buyer must spend $50,000 next year to replace them.

- The Reality: You can't just pretend the equipment lasts forever. While you add back depreciation for EBITDA/SDE, be prepared for buyers to deduct a "CapEx Reserve" from the final cash flow calculation.

3. Market-Rate Expenses

- Rent: If the seller owns the building and pays no rent, you must deduct a fair market rent expense. You can't show a profit based on free rent.

- Working Capital: Standard inventory purchases are not expenses to be added back; they are cost of goods sold (COGS).

Documentation Standards: The "Shield"

In a survey of business brokers, "inaccurate data" is frequently cited as a primary reason deals die [1]. Defend your valuation with the TIER system:

- Tier 1 (Gold): Third-party source documents (invoices, bank statements, lease agreements) clearly matching the P&L.

- Tier 2 (Silver): General ledger details with clear vendor names (e.g., "Disney World Resort" under "Travel").

- Tier 3 (Bronze): Seller's handwritten notes or estimates. (Expect buyers to haircut this by 50-100%).

Add-Back Presentation

When building your Confidential Information Memorandum (CIM), clarity is king. Don't bury add-backs in a footnote. Create a clean, transparent bridge.

SDE Add-Back Schedule Example

Category | Amount | Documentation Status |

|---|---|---|

Net Income (Reported) | $110,000 | Tax Returns |

Owner's Salary | + $95,000 | W-2s |

Health Ins. (Owner) | + $18,000 | Benefit Stmts |

Personal Auto (80%) | + $9,600 | Mileage Log |

Depreciation | + $22,000 | Tax Return (Sch L) |

Interest Exp. | + $5,000 | P&L |

One-time Legal Fee | + $12,000 | Settlement Inv. |

SDE (Normalized) | $271,600 |

Handling Disputes

When a buyer challenges an add-back (and they will), don't take it personally. It's part of the dance.

- "That seems high."

- Response: "Here are the market comps for this expense. We used the lower end of the range to be conservative."

- "I'll have to pay that, too."

- Response: "This specific expense was for the owner's personal networking at a country club. Unless you plan to join the same club, it’s discretionary."

- "No documentation."

- Response: If you can't produce the paper, concede the point. It builds trust to say, "Fair enough, we'll remove that $2,000 item." It saves the credibility of the other $200,000 in add-backs.