You have the perfect seller—motivated, realistic on price, and running a solid business. You find a buyer who loves the story and the strategic fit. They sign the LOI. You crack open the champagne (or at least a good craft beer).

Then, due diligence starts.

The buyer's CPA asks for the supporting docs for the add-backs. The seller hands over a shoebox of receipts and a "trust me" smile. The "one-time" legal fees turn out to be a recurring lawsuit problem. The "personal vehicle" is actually a delivery van essential to operations.

The deal dies a slow, painful death.

A well-crafted CIM financial section prevents this nightmare. Statistics show that anywhere from 50% to 90% of deals fall apart during due diligence, and messy financials are consistently a top killer [1][2]. As business brokers, we must create a CIM financial presentation that controls the narrative before the accountants get involved. This guide shows you how to build financial sections that withstand scrutiny and close deals.

The CIM financial section isn't just documentation—it's your first line of defense against deal failure and your most powerful tool for building buyer confidence.

CIM Financial Section Checklist:

What Your CIM Financial Section Must Accomplish

Your financial presentation isn't just a data dump; it's a sales argument built on math. It needs to:

- Demonstrate profitability: Prove the business generates attractive returns (SDE or EBITDA) that justify the multiple.

- Establish credibility: If your numbers in the CIM don't match the tax returns (to the penny), you look sloppy. If they do match, you look professional.

- Support valuation: Clearly show how you arrived at the SDE. "Dry powder" investors want to see the logic, not just the result.

- Anticipate the "Tire Kickers": A clear financial section weeds out unserious buyers who don't understand the business model, saving you time.

Core Elements of an Effective CIM Financial Section

Historical Performance: The Foundation of CIM Financial Data

Buyers look for trends first, absolute numbers second. They want to see the trajectory. Present 3-5 years of performance data clearly.

Pro Tip: Don't make buyers squint at a PDF scan of a QuickBooks export. Recast the financials into a clean, standardized table.

Metric | 2021 | 2022 | 2023 | 2024 YTD |

|---|---|---|---|---|

Revenue | $1,800,000 | $2,100,000 | $2,400,000 | $1,850,000* |

Cost of Goods Sold | $720,000 | $819,000 | $912,000 | $703,000 |

Gross Profit | $1,080,000 | $1,281,000 | $1,488,000 | $1,147,000 |

Gross Margin | 60% | 61% | 62% | 62% |

Operating Expenses | $780,000 | $891,000 | $1,008,000 | $777,000 |

Net Income | $300,000 | $390,000 | $480,000 | $370,000 |

Net Margin | 17% | 19% | 20% | 20% |

*Annualized: $2,467,000

Year-to-Date Financials in Your CIM

If you are selling a business in October, and your CIM only has data through last December, you look like you're hiding something. Always include current year performance with context.

- Show actual YTD figures: Don't guess.

- Compare to same period prior year: "Up 3% vs YTD 2023" is a powerful confidence builder.

- Annualize responsibly: If the business is seasonal (e.g., a landscaping firm), simple linear annualization will result in a wild valuation error. Note seasonality explicitly.

Example:

Through September 30, 2024, revenue of $1,850,000 represents a 3% increase over the same period in 2023 ($1,796,000). Annualized revenue of approximately $2.47M suggests a stable growth trajectory despite industry headwinds.

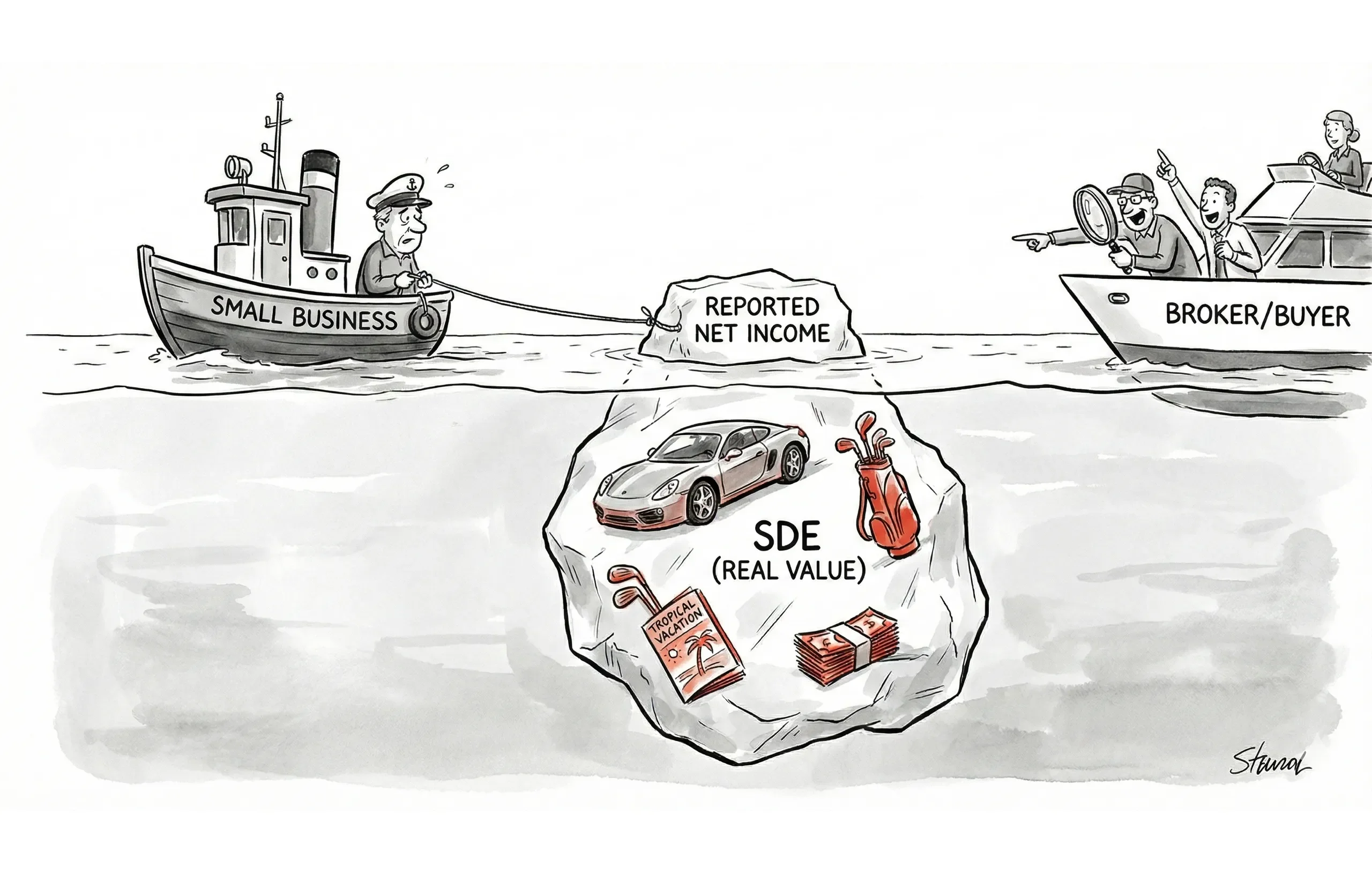

SDE Calculation: The Heart of Your CIM Financial Section

This is where the battle for value is won or lost. Seller’s Discretionary Earnings (SDE) is the standard metric for businesses with under $5M in revenue [4]

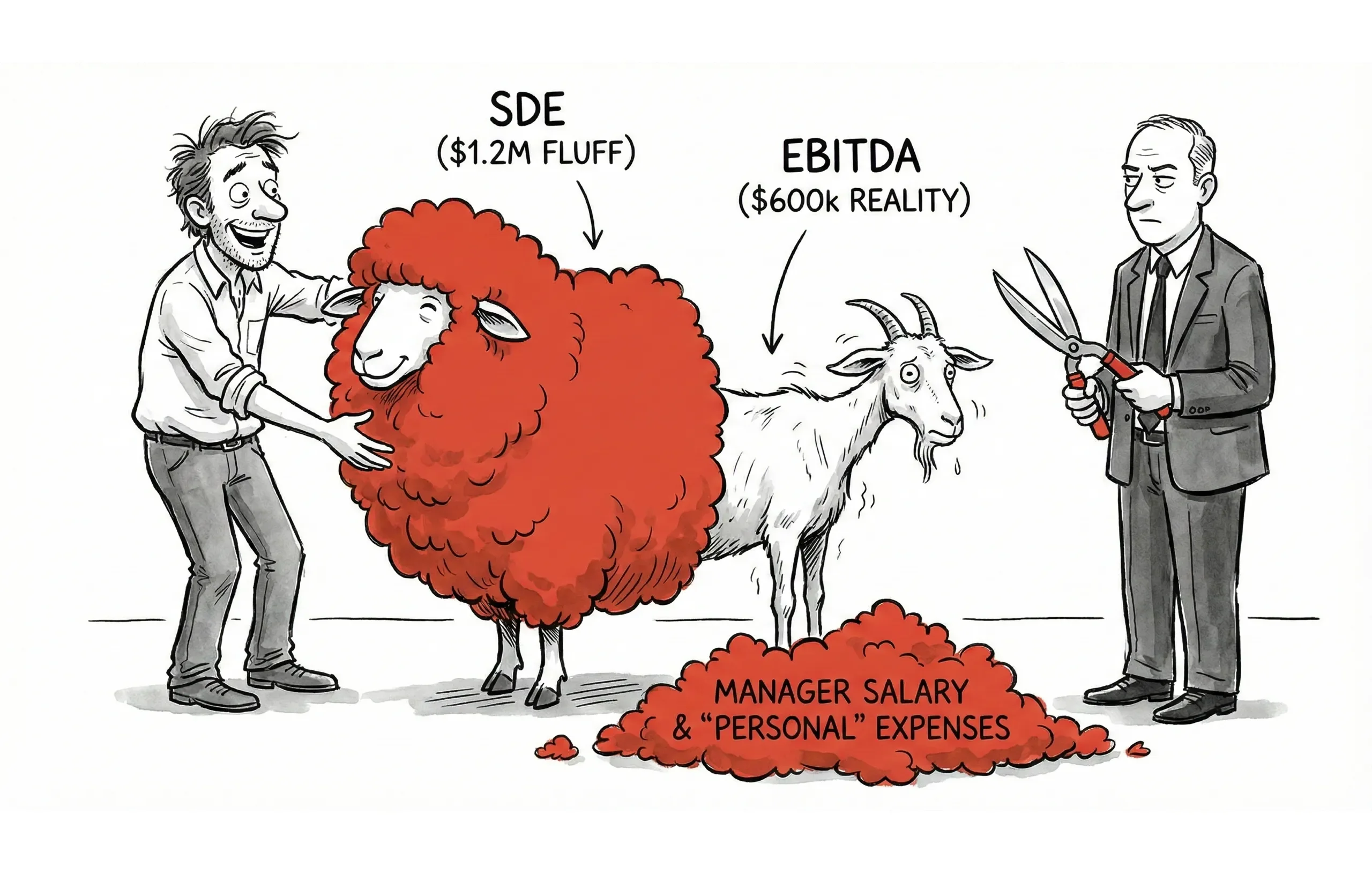

However, there is a fine line between a "valid add-back" and "creative fiction." Crossing it destroys trust.

Building a Complete Add-Back Schedule for Your CIM

Present SDE clearly with a line-by-line breakdown. Do not bury these in a footnote.

Seller's Discretionary Earnings (SDE) Calculation

Line Item | 2022 | 2023 | 2024E | Notes |

|---|---|---|---|---|

Net Income (per tax return) | $390,000 | $480,000 | $495,000 | Must match tax returns |

Add-Backs: | ||||

Owner's Salary | $120,000 | $150,000 | $150,000 | W-2 compensation to owner |

Owner's Payroll Taxes | $9,180 | $11,475 | $11,475 | Employer portion only |

Owner's Health Insurance | $24,000 | $26,400 | $28,000 | Family plan |

Owner's Retirement | $19,500 | $22,500 | $23,000 | 401(k) match |

Owner's Vehicle Expenses | $12,000 | $14,400 | $15,000 | Personal use 80% |

Owner's Cell Phone | $1,800 | $1,800 | $1,800 | |

Owner's Travel/Ent. | $8,000 | $6,500 | $7,000 | Non-business portion |

Depreciation | $18,000 | $22,000 | $24,000 | Non-cash expense |

Interest Expense | $4,500 | $3,200 | $2,000 | Financing choice |

One-time Legal Fees | $0 | $15,000 | $0 | Contract dispute (resolved) |

Total Add-Backs | $217,180 | $273,275 | $262,275 | |

SDE | **$607,180** | $753,275 | $757,275 |

CIM Financial Documentation Requirements

If you can't prove it, you can't add it back. Prepare your seller for this reality early.

Add-Back | Documentation Required |

|---|---|

Owner salary | W-2s, payroll reports. |

Personal expenses | Receipts, credit card statements, % allocation rationale (e.g., mileage logs). |

One-time items | Invoices, settlement agreements, explanation of non-recurring nature. |

Related party adjustments | Market rate analysis (e.g., "Here are 3 comps for warehouse rent in this zip code"). |

The "Danger Zone" of CIM Add-Backs

Universally Accepted:

- Owner's salary, benefits, payroll taxes.

- Depreciation, amortization, interest.

Accepted with Documentation:

- Personal vehicle (if not a delivery truck).

- Family member wages (if they don't actually work there).

- One-time legal fees (e.g., a settled lawsuit).

The Deal Killers (Avoid These):

- "Hidden" cash: "We make $50k in cash that we don't declare." (This is tax fraud, not an add-back. Do not put this in writing).

- Future improvements: "You could save $20k if you switched insurance." (That's a synergy for the buyer, not SDE for the seller).

- Aggressive personal expensing: Classifying the entire family vacation to Disney World as a "board meeting."

Presenting Revenue Trends in Your CIM Financial Section

Revenue Growth Analysis:

Year | Revenue | Growth | Key Drivers |

|---|---|---|---|

2020 | $1,500,000 | - | Base year |

2021 | $1,800,000 | +20% | Added service line B |

2022 | $2,100,000 | +17% | Market expansion |

2023 | $2,400,000 | +14% | Price increases, volume |

2024E | $2,470,000 | +3% | Market normalization |

CAGR (2020-2024): 13.3%

Margin Analysis for CIM Financial Statements

Margins tell the story of operational efficiency. If margins are slipping, address it before the buyer discovers it.

"Gross margins improved from 60% to 62% over three years. This wasn't accidental; the seller renegotiated vendor contracts in Q1 2022 and implemented new inventory management software in 2023."

Balance Sheet Presentation in CIM Financials

The P&L gets the glory, but the Balance Sheet kills the deal if Working Capital isn't understood.

Creating a Summary Balance Sheet for Your CIM

Category | Amount | Notes |

|---|---|---|

Current Assets | ||

Cash | $45,000 | Excluded from sale |

Accounts Receivable | $185,000 | Excluded; seller retains |

Inventory | $75,000 | Included at landed cost |

Fixed Assets | ||

Equipment (net) | $125,000 | Included (FMV approx $150k) |

Vehicles (net) | $45,000 | Included |

Liabilities | $0 | Seller pays off all debt at closing |

Broker Note: Be explicitly clear about AR/AP. In smaller deals, it's common for the seller to keep AR and pay off AP (cash-free, debt-free). If the buyer is expected to take on AR, state that clearly, as it impacts the Working Capital Peg.

How to Present Challenging Financials in a CIM

Every business has warts. If you hide them, you lose trust. If you frame them, you manage risk.

1. Declining Revenue

- Bad: Ignoring it.

- Good: "Revenue declined 8% in 2023 due to the intentional pruning of low-margin customers. While top-line dropped, Net Profit actually increased by 2%."

2. Inconsistent Margins

- Bad: "Fluctuations due to market conditions."

- Good: "Gross margin dipped in 2022 due to a one-time inventory write-down of $45k for obsolete parts. Normalized margin remains steady at 60%."

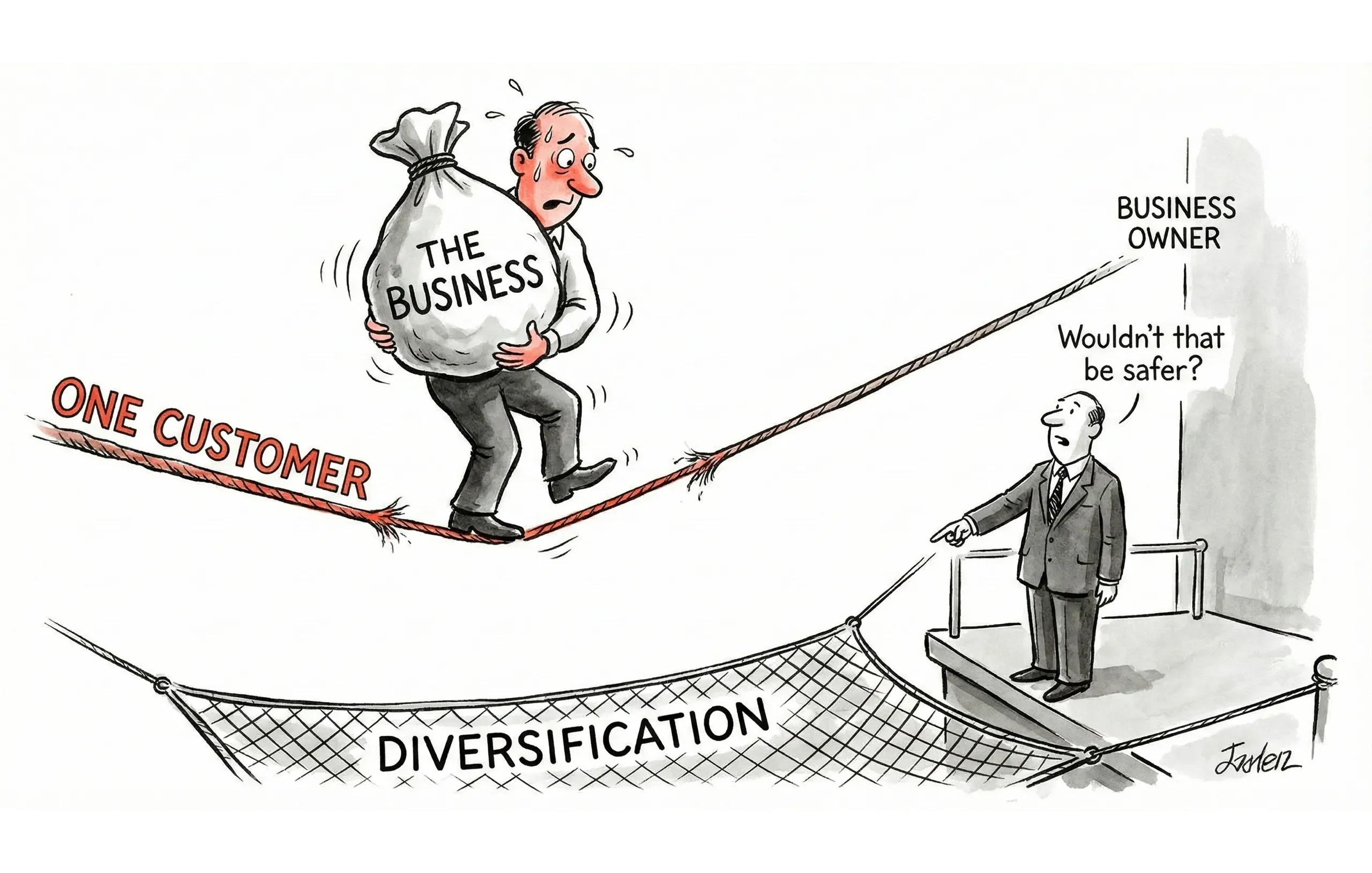

3. Customer Concentration

- Bad: Hoping they don't notice Amazon is 40% of sales.

- Good: "Customer A represents 40% of revenue. However, this relationship is under a 3-year contract (transferable) and has been in place for 12 years."

Common CIM Financial Section Mistakes to Avoid

Mistake | Why it hurts |

|---|---|

Aggressive Add-Backs | Signals the seller is unrealistic; makes the broker look complicit. |

Missing Documentation | Delays due diligence; "Time kills all deals." |

Inconsistent Numbers | If the CIM says $500k EBITDA and the tax return says $100k, you have a lot of explaining to do. |

Too Much Detail | A 40-page general ledger dump overwhelms buyers. Summarize first, detail later. |

Frequently Asked Questions About CIM Financial Sections

Q: How many years of financials should a CIM include?

A: Include 3-5 years of historical financial performance in your CIM financial section. This provides enough data for buyers to identify trends while keeping the presentation focused.

Q: What's the difference between SDE and EBITDA in a CIM?

A: SDE (Seller's Discretionary Earnings) is used for businesses under $5M in revenue and includes owner compensation. EBITDA is used for larger businesses and excludes owner-specific benefits.

Q: How detailed should add-back documentation be in the CIM?

A: Your CIM financial section should include a clear add-back schedule with explanatory notes. Save detailed documentation (receipts, invoices) for the due diligence phase, but ensure it's ready.

Q: Should a CIM financial section include balance sheet information?

A: Yes. Always include a summary balance sheet in your CIM financial presentation, clearly noting what assets transfer with the sale and how working capital will be handled.

Q: How do you handle declining revenue in a CIM financial section?

A: Address it proactively with context. For example, explain if revenue declined due to intentional customer pruning that improved margins, or seasonal factors affecting the comparison period.

Build CIM Financial Sections That Close Deals

Your CIM financial section makes or breaks the deal. When it's solid, negotiations focus on price and terms. When it's shaky, negotiations become about trust—and that's a losing battle for any business broker.

The difference between a deal that closes and one that dies in due diligence often comes down to financial presentation quality. Smart brokers know that investing time upfront in a comprehensive CIM financial section pays dividends when buyers' CPAs start asking questions.

Key Takeaways for Building Strong CIM Financial Sections:

- Present 3-5 years of historical performance with clean, standardized tables that highlight trends

- Build defensible SDE calculations with line-by-line add-back schedules backed by documentation

- Include current YTD financials with year-over-year comparisons and proper seasonality notes

- Address challenges proactively by framing issues before buyers discover them

- Support every add-back with documentation your seller can produce during due diligence

Your Next Steps

As a broker, your reputation depends on bringing credible deals to market. Take the time to recast properly. Push back on sellers when they want to add back questionable expenses. Your CIM financial section should be so thorough that the buyer's CPA says, "This is exactly what I needed."

Ready to elevate your CIM financial presentations? Download our CIM Template for Business Brokers and start building financial sections that withstand the toughest due diligence scrutiny.

Works Cited 4 sources cited

- Coldstream Capital Partners: "5 Common Reasons Why Business Sales Fall Apart During Due Diligence" (2025). Link

- MidStreet Mergers & Acquisitions: "The Top 5 Reasons Sales Fail." Link

- UpCounsel: "Understanding Add Backs in Cash Flow Analysis." Link

- Quiet Light Brokerage: "SDE explained: Seller’s discretionary income and why it matters." Link