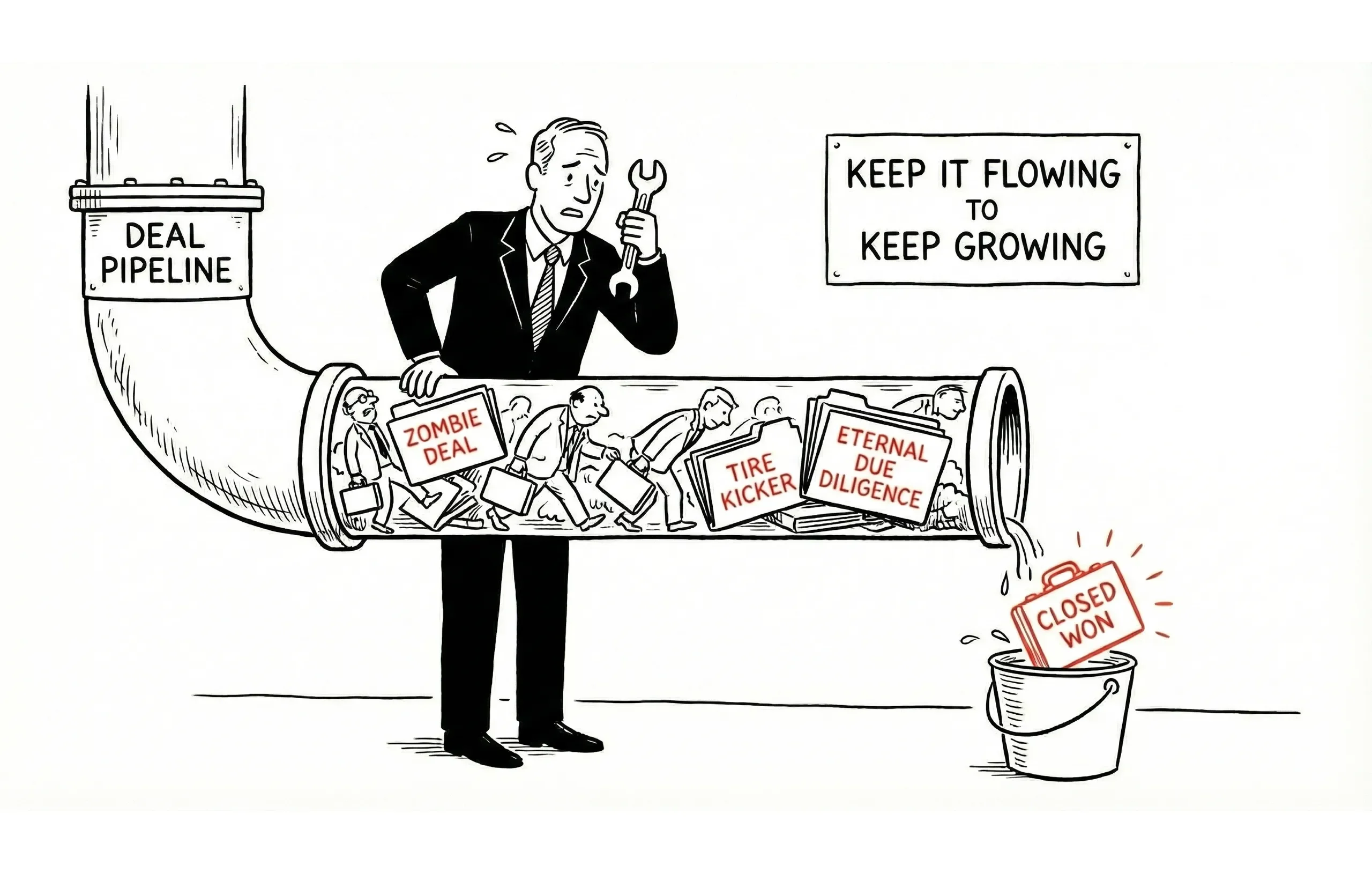

As a business broker, mastering SBA loan business buyer qualification is the difference between closing deals and wasting 90 days on unqualified prospects. You've been there—a promising buyer, signed LOI, opened escrow—then the lender calls: "We can't get there."

The buyer's "cash" was a recent gift from a cousin. They forgot about a student loan default from 15 years ago. Your deal dies, and you've lost your commission.

In Main Street M&A (deals under $5M), the SBA 7(a) loan powers approximately 80% of transactions. Yet rejection rates hover around 42% for improperly qualified buyers (source). Your ability to pre-screen for SBA loan business buyer qualification isn't optional—it's essential to protecting your time and closing ratio.

This guide covers the specific SBA 7(a) buyer qualification requirements for 2025, including stricter equity injection rules under SOP 50 10 8, and how to identify financing red flags before they derail your deals.

SOP 50 10 8 Hard Rules: What Changed in June 2025

On April 22, 2025, the SBA announced significant changes to its 7(a) and 504 loan programs through SOP 50 10 8, effective June 1, 2025. According to the Congressional Research Service, these changes restore pre-2023 underwriting standards and eliminate the "do what you do" flexible approach. Here are the hard rules every broker must know:

Citizenship Requirements (Stricter)

- 100% U.S. Ownership Required: All direct and indirect owners, loan guarantors, and key employees must be U.S. citizens or legal permanent residents.

- Ineligible Persons: Foreign nationals, refugees, asylees, conditional LPRs, visa holders (including E-2), DACA participants, and undocumented immigrants.

- Major Change: Previously, businesses only needed 51% ownership by U.S. citizens/LPRs. This is now 100%.

Equity Injection (10% Minimum Restored)

- Start-ups and Changes of Ownership: Minimum 10% of total project costs required (restoring pre-2023 requirements).

- Seller Notes as Equity: Can only count if on full standby for the life of the loan AND cannot exceed 50% of required equity injection.

- Partner Buyouts: For loans over $350,000, must achieve at least 10% net worth (maximum 9:1 debt-to-worth ratio).

Collateral Requirements (Much Stricter)

- New Threshold: Collateral required for all loans over $50,000.

- Old Threshold: Previously $500,000.

- Impact: Most acquisition loans will now require personal collateral, typically a lien on the buyer's residence.

Credit & Verification Standards

- Business Credit Score: Minimum raised from 155 to 165.

- Tax Verification: IRS tax transcripts required for all loans (no exceptions).

- Ownership Disclosure: Must provide information on at least 81% of direct and indirect ownership, including date of birth for all listed owners.

7(a) Small Loan Changes

- New Threshold: 7(a) small loans now capped at $350,000 (down from $500,000).

- Impact: Loans between $350k-$500k now face full underwriting requirements.

Broker Reality Check: The 2024 7(a) program recorded approximately $397 million in negative cash flow, prompting these stricter measures. The days of flexible underwriting are over—screen your buyers against these hard rules before you waste time on a deal that can't close.

Understanding SBA Loan Buyer Qualification Basics

What is an SBA 7(a) Loan?

The SBA 7(a) is the Small Business Administration's flagship program. It's important to clarify to your buyers that the SBA doesn't lend the money; they provide a guarantee (typically 75% for loans over $150k) to the bank, which mitigates risk and encourages lenders to finance "blue sky" (goodwill) that conventional banks won't touch.

The 2025 Snapshot:

- Loan Cap: Up to $5 million.

- Maturity: 10 years for business acquisition (up to 25 if real estate is the majority asset).

- Interest Rates: Variable, usually Prime + 2.25% to 2.75%.

- Leverage: Lenders typically want a 1.15x to 1.25x Debt Service Coverage Ratio (DSCR).

Why It Matters to Brokers

You might prefer cash buyers—we all do. But "dry powder" is often tied up in PE funds that won't look at anything under $1M EBITDA. For the individual searcher or the strategic buyer looking at a $2M deal, SBA is often the only path to closing. Effective SBA loan business buyer qualification separates top brokers from the rest. If you can't navigate these requirements, you're leaving 80% of the buyer pool on the sidelines.

SBA Buyer Qualification: Eligibility Requirements for 2025

The SBA looks at the "whole person" concept, but they have hard lines in the sand.

Personal Qualifications

Citizenship & Status

- Requirement: Under SOP 50 10 8, 100% of owners, guarantors, and key employees must be U.S. citizens or Lawful Permanent Residents (Green Card holders).

- The Trap: E-2 visa holders, DACA participants, refugees, asylees, and any other non-citizen/non-LPR status are now completely ineligible. The old workaround of having a U.S. citizen co-borrower with 51% ownership no longer works—pivot to non-SBA lenders immediately.

Credit History

- Score: While the SBA doesn't set a hard minimum, most PLP (Preferred Lender Program) banks require a FICO of 680+.

- Clean Slate: The SBA has zero tolerance for federal debt defaults. If a buyer has a defaulted student loan or an unresolved tax lien, they are automatically disqualified until it is "cured."

- Bankruptcy: A Chapter 7 bankruptcy must be discharged for at least 3 years. A Chapter 13 must be discharged for 1 year.

Broker Tip: Don't just ask "How is your credit?" Ask specifically, "Have you ever defaulted on a government-backed loan, including student loans?" That's the silent deal-killer.

Character Issues

- Criminal Record: A felony doesn't always disqualify, but crimes of "moral turpitude" (fraud, embezzlement, grand larceny) usually do. Lenders will run a background check on anyone owning 20% or more.

Financial Qualification Requirements: Equity Injection Rules

This is where most SBA loan business buyer qualification efforts fail. Under the current SOP 50 10 8 rules (effective mid-2025), the "skin in the game" requirements are strict.

The "10% Rule"

The buyer generally needs to inject 10% of the total project cost (purchase price + working capital + closing costs).

Source of Funds Requirements:

- Seasoning: Money must be in the buyer's account for at least 2 months (two bank statement cycles) to prove it isn't borrowed.

- No Borrowed Funds: Buyers cannot borrow their down payment (e.g., a personal loan) unless they have an outside source of income to repay it independent of the business they are buying.

- HELOCs: Home Equity Lines of Credit are allowed as equity, provided the buyer has outside income (like a spouse's salary) to service that debt.

Experience Requirements

Lenders invest in management, not just assets.

- Direct Experience: If a buyer is an engineer buying a manufacturing plant, great.

- Transferable Skills: If a marketing exec wants to buy a plumbing company, they need a narrative. How will they manage technical staff?

- The Fix: If experience is weak, keep the seller on for a 6-12 month transition (consulting agreement) to comfort the lender.

Business Eligibility Requirements

Not every listing is SBA-eligible. Before you take a listing, screen it against these exclusions.

Ineligible Businesses:

- Lending/Speculation: Banks, life insurance companies, real estate investment firms.

- Passive Income: Mobile home parks or shopping centers (unless structured carefully as an operating business).

- Vice Industries: Gambling, adult entertainment, or businesses restricting patronage (e.g., "men only" clubs).

- Non-Profits: SBA 7(a) is for-profit only.

Loan Amount and Structure

How do you structure the "Capital Stack" to make the deal work?

Typical Deal Structure ($1M Acquisition)

With the updated SOP rules regarding seller notes, here is a common structure:

Component | % of Project | Amount | Notes |

|---|---|---|---|

SBA Lender | 80% - 90% | $800k - $900k | Primary lien holder. |

Buyer Cash | 10% | $100k | Minimum 10% is standard for acquisitions (change of ownership). |

Seller Note | 0% - 10% | $0 - $100k | Can bridge gaps in valuation or equity. |

The "Seller Note as Equity" Nuance

Under SOP 50 10 8, a seller note can count towards the buyer's equity requirement ONLY IF:

- It is on full standby (no payments of principal or interest) for the life of the SBA loan (typically 10 years).

- It represents no more than 50% of the total required equity injection.

- Old Rule: Standby for 2 years.

- New Rule: Standby for life of loan AND capped at 50% of equity requirement.

Broker Takeaway: With the 50% cap, the buyer must bring at least 5% in cash—seller notes can only cover the other half. If your buyer has less than 5% cash, they cannot qualify even with a seller note. Verify your buyer has the full 10% cash whenever possible.

What Disqualifies Buyers? (The Cheat Sheet)

Print this out and keep it by your phone.

Automatic Disqualifiers

- Non-U.S. Status: Any owner, guarantor, or key employee without citizenship or Green Card disqualifies the entire deal (100% requirement under SOP 50 10 8).

- Current Bankruptcy: Or recent discharge (<3 years for Ch. 7).

- Federal Default: "I'm fighting the IRS on a tax lien" = disqualified.

- Criminal Record: Financial crimes or recent parole.

- Business Credit Score Below 165: New minimum threshold under SOP 50 10 8.

"Story" Disqualifiers (Deal Killers if not explained)

- Job Hopping: Gaps in employment history.

- Divorce: Pending settlements can freeze assets.

- Customer Concentration: If the business they are buying has one client >30% of revenue, the business might disqualify the buyer.

How to Pre-Qualify Buyers for SBA Loan Approval

SBA loan business buyer qualification requires verification, not assumptions.

Don't Trust, Verify.

Pre-qualification is not a pre-approval letter from a mortgage broker. In business lending, it means a lender has reviewed the buyer's financials and the business's tax returns.

The "Letter of Interest" Test

Ask your buyers: "Have you spoken to an SBA lender yet?"

- If No: Send them to a preferred lender immediately.

- If Yes: Ask for the term sheet or email confirmation.

Documents needed for a credible pre-qual:

- Personal Financial Statement (PFS) - SBA Form 413.

- Three years of personal tax returns.

- Resume/Bio.

- Proof of liquidity (screenshot of bank accounts).

Streamlining Your SBA Buyer Qualification Process

You don't want to interrogate buyers, but you do need to be efficient. Here is a conversational script to vet them without killing the vibe.

The "Peer-to-Peer" Script:

- "I see you're interested in the logistics company. Just so I can help structure the deal right, are you planning to use SBA financing or do you have private capital aligned?"

- "Great, SBA is the way to go. Do you have that 10-15% liquidity readily available, or would we need to get creative with a seller note?"

- "SBA lenders are getting strict on the 'seasoning' of funds—is your down payment sitting in cash, or do we need to liquidate some stocks/crypto first?"

Red Flag Responses:

- "I have investors." (SBA rules on passive investors are complex; usually means they aren't the actual buyer).

- "I'm going to borrow against my 401k." (This is fine via a ROBS plan, but takes time. Ask if they have started the process).

- "My credit is a little dinged up." (Ask for the score immediately).

Common Scenarios

Scenario 1: The "Cash Poor" High Earner

Buyer: High income W-2 employee, but low savings. Solution: Look for a ROBS (Rollover for Business Startups) provider. They can use their existing 401(k) tax-free to fund the equity injection. This is a legitimate strategy used in thousands of deals.

Scenario 2: The "Add-Back" Aggressor

Buyer: Wants to buy a business priced at $1M but claims the "real" EBITDA is lower, so the bank won't fund it. Reality: The bank uses tax returns, not your CIM's adjusted EBITDA. If the tax returns don't show enough cash flow to cover the loan payments (DSCR), the deal dies. Action: Ensure your add-backs are "bankable" (one-time expenses), not "lifestyle" (personal cars/meals) that the bank might reject.

Scenario 3: The Gap

Buyer: Has $100k. Deal is $1.2M. Analysis: $100k is only 8.3%. Total equity needed: $120k (10%). Fix: Under SOP 50 10 8, seller can only cover 50% of equity requirement ($60k max). Buyer needs at least $60k cash. With $100k, buyer is fine—seller carries $20k on full standby for life of loan. Buyer puts in $100k cash. Bank lends $1.08M. Warning: If the buyer only had $50k, this deal would NOT work—seller notes can't exceed 50% of the equity requirement.

Frequently Asked Questions

How long does SBA loan approval take?

From signed LOI to closing, budget 60 to 90 days. If a lender promises 30 days on an acquisition, they are likely over-promising.

Can buyers use a HELOC for the down payment?

Yes, BUT they must prove they can repay the HELOC from other income sources (spouse's salary, investment income), not from the cash flow of the business they are buying.

Does the SBA require collateral?

Under SOP 50 10 8, collateral is now required for all loans over $50,000 (previously $500,000). Lenders must take "all available collateral" up to the loan amount. For acquisition loans, this almost always means a lien on the buyer's personal residence if the business assets don't fully cover the loan. Buyers need to be mentally prepared for this—it's no longer optional for most deals.

Mastering SBA Loan Business Buyer Qualification

As a broker, your success hinges on qualifying the right buyers before you invest time in a transaction. SBA loan business buyer qualification is a systematic process: verify citizenship status, confirm credit history, validate equity sources, assess relevant experience, and ensure business eligibility.

The landscape has tightened under SOP 50 10 8. The 10% equity injection must be seasoned, seller notes require full standby for the loan's life, and federal debt defaults remain automatic disqualifiers. These aren't suggestions—they're hard requirements that kill deals.

Your next steps:

- Implement a formal SBA buyer qualification checklist before sending any CIM

- Build relationships with 2-3 preferred SBA lenders who can pre-qualify buyers quickly

- Ask the critical questions early: citizenship, credit score, federal defaults, and fund seasoning

- Keep the "Automatic Disqualifiers" list by your phone.