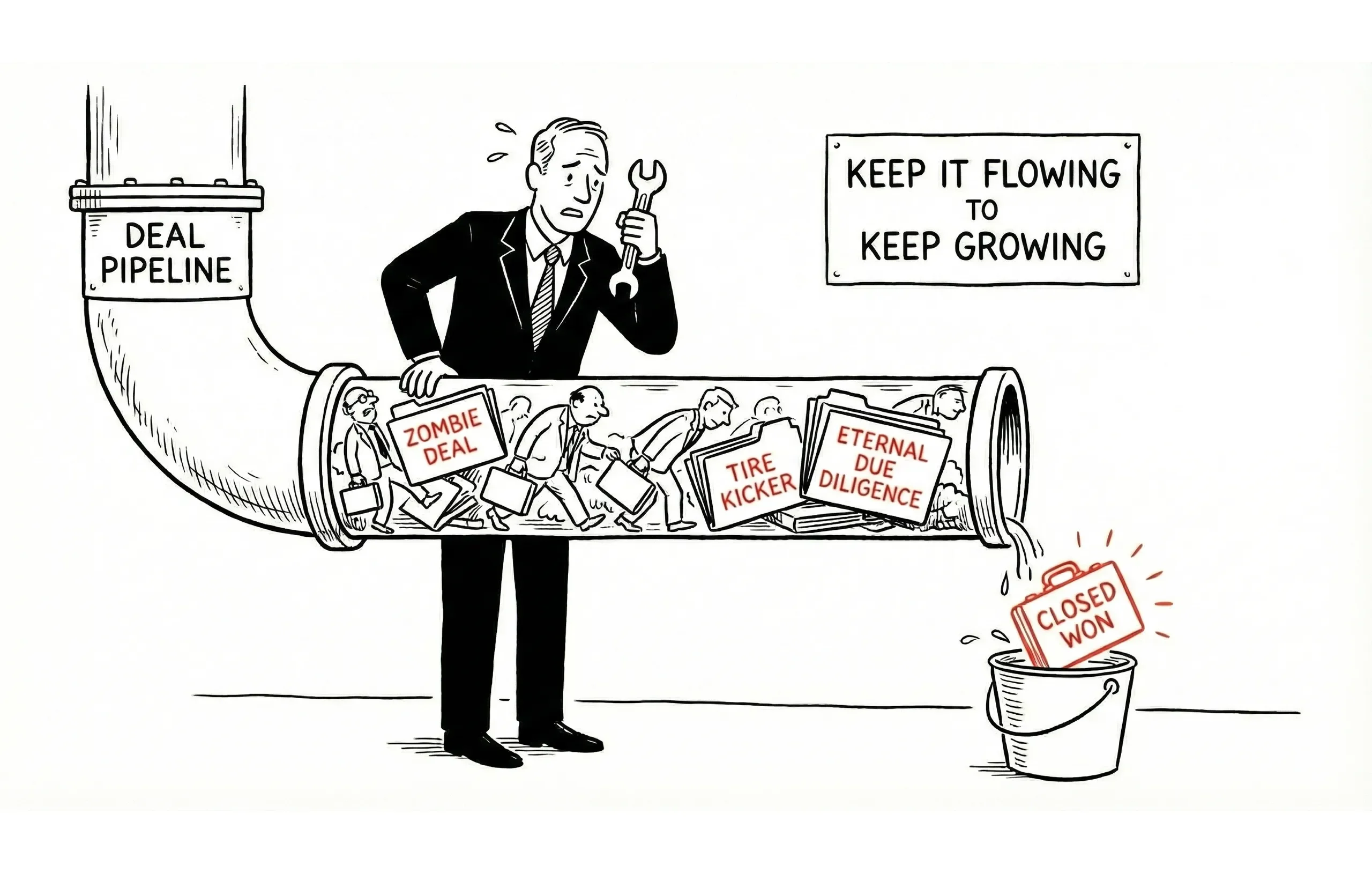

We've all been there. You find a business with solid revenue, a charismatic owner, and a decent product. You list it, find a buyer, and get the LOI signed. Then, during due diligence, the skeletons start dancing.

Maybe it's the "personal" expenses buried in the P&L that aren't quite add-backs. Maybe it's the fact that the owner is the sales team. The deal stalls. The buyer gets cold feet. The "perfect" deal dies a slow, painful death.

The reality of our industry is stark: according to the Exit Planning Institute, while 75% of business owners want to exit within 10 years, only about 20-30% of businesses that go to market actually sell [1].

The difference between the 20% that close and the 80% that languish usually comes down to one factor: the business sale preparation timeline.

Whether you're advising a client who is planning years ahead or managing a seller who needs out yesterday, understanding the preparation timeline is your best weapon against deal fatigue. Here's the reality of what it takes to get a business diligence-ready.

The 18-24 Month Business Sale Preparation Timeline

If we could wave a magic wand, every seller would call us two years before they wanted to list. This business sale preparation timeline allows for the deep structural work that actually drives multiple expansion.

Best for: Maximizing valuation and fixing deal killers like high customer concentration or owner dependency.

Phase | Timing | Focus |

|---|---|---|

Assessment | Months 24-22 | Identify deal killers early (owner dependency, customer concentration). |

Major Fixes | Months 22-18 | Address structural issues while there's still runway. |

Value Building | Months 18-12 | Enhance operations to show a growth trend, not just stability. |

Documentation | Months 12-6 | Clean up the books so financials are audit-ready. |

Fine-Tuning | Months 6-3 | Final operational polish. |

Listing Prep | Months 3-0 | Launch readiness (CIM creation, teaser distribution). |

Why this timeline wins: You have time to create a clean trailing twelve months (TTM). Buyers love boring due diligence. When a seller spends two years cleaning up their act, the buyer's quality of earnings (QofE) report comes back clean, and deal momentum stays high through closing.

The 12-Month Preparation Timeline for Business Sales

This is the bread and butter for most SMB brokers. The business is reasonably healthy, but the owner hasn't organized their exit strategy.

Best for: Businesses with decent operations but messy documentation.

Phase | Timing | Focus |

|---|---|---|

Assessment | Month 12 | Quick evaluation of marketability. |

Priority Fixes | Months 12-9 | Triage: Fix only what hurts value most. |

Documentation | Months 9-6 | Financial recasting and legal clean-up. |

Operations | Months 6-3 | Tightening SOPs and delegation. |

Launch Prep | Months 3-0 | Final readiness. |

The Broker's Angle: At 12 months, you aren't fixing the business model—you're packaging it. This is where you identify the hair on the deal and figure out how to explain it upfront, rather than hoping the buyer misses it (spoiler: they won't).

The Accelerated 6-Month Sale Preparation Timeline

We often see this compressed business sale preparation timeline when an owner faces burnout or a sudden life change. They have a dry powder buyer in mind or just want out.

Best for: Businesses that are already operationally sound and well-organized.

Phase | Timing | Focus |

|---|---|---|

Assessment | Month 6 | Rapid evaluation (Go/No-Go decision). |

Critical Items | Months 6-4 | Fixes limited to red flags only. |

Documentation | Months 4-2 | Gathering essential docs (tax returns, P&Ls). |

Launch Prep | Months 2-0 | Quick readiness. |

The Risk: BizBuySell data suggests the median time on market hovers around 149 days [2]. If a seller rushes the 6-month prep, they often end up sitting on the market longer because buyers smell desperation or disorganization.

The 3-Month Fire Sale Timeline

Best for: Urgent health issues, divorce, or partnership disputes.

Phase | Timing | Focus |

|---|---|---|

Assessment | Month 3 | Quick scan for major liabilities. |

Essentials | Months 3-1 | The bare minimum to pass legal muster. |

Launch | Month 1-0 | Go to market immediately. |

The Reality Check: Expect a lower multiple. Buyers will price in the risk of the unknown. As brokers, our job here is managing seller expectations: "We can sell it fast, or we can sell it for top dollar. We likely cannot do both."

What Extends the Business Sale Preparation Timeline

Why does preparation actually take 18 months? It's not the paperwork—it's the people and the processes.

Owner Dependency (12-18 Months to Resolve)

If the owner is the business, you don't have a business to sell—you have a job vacancy. Transitioning key relationships and institutional knowledge to a management team cannot be rushed.

The danger: Buyers will demand a heavy earn-out structure to protect themselves, keeping the seller tied to the business long after closing.

Customer Concentration (12-24 Months to Resolve)

If one client makes up 30% or more of revenue, that's a massive risk profile. Diluting that concentration requires acquiring new customers, which takes sales cycles—not just paperwork.

Financial Cleanup (1-3 Months)

This is the low-hanging fruit in any business sale preparation timeline. We can recast financials and normalize add-backs relatively quickly compared to fixing operational flaws.

The Cost of Compressing the Preparation Timeline

When a seller insists on rushing to market, they're trading time for money.

- Lower Sale Price: Uncertainty discounts value. Buyers adjust their offers to account for undiscovered risks.

- Extended Due Diligence: If the data room isn't ready, the buyer's team will dig manually. Every day the deal drags on, the likelihood of closing drops.

- Transition Nightmares: Without documented SOPs, the handover is rocky—often jeopardizing the seller's earn-out or seller note payments.

Setting Client Expectations on Sale Preparation Timelines

Your value as a broker isn't just in finding a buyer—it's in coaching sellers to be findable.

A staggering 49% of owners want to exit in the next 5 years, yet many lack a formal valuation or plan [3]. This is your opportunity. By educating clients on realistic business sale preparation timelines early, you turn tire kickers into prepared sellers—and stalled deals into closed transactions.

The brokers who consistently close deals aren't just better at marketing listings. They're better at having the timeline conversation before the listing agreement is signed.