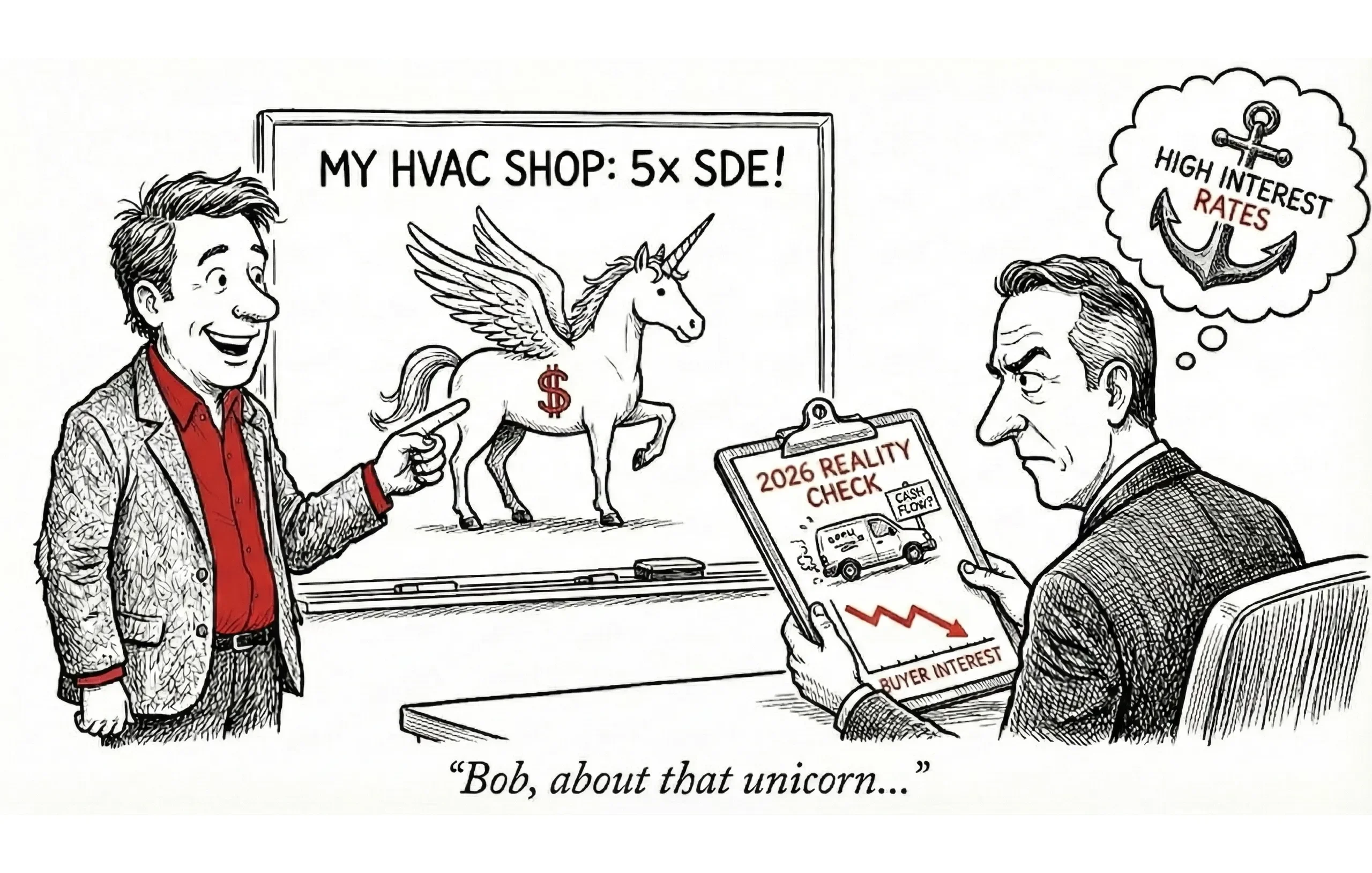

We’ve all been there. You’re sitting across from a seller—let’s call him "Bob"—who owns a solid, consistent HVAC company. He’s a great guy, runs a tight ship, and has a clean P&L. But when you ask about his valuation expectations, Bob leans back and drops a bomb: "Well, my buddy sold his tech startup for 6x revenue last year, so I figure my business is worth at least 5x earnings."

The air leaves the room. You know, and the market knows, that a 5x SDE (Seller’s Discretionary Earnings) multiple for a Main Street HVAC shop is a unicorn sighting. It’s the classic "perfect buyer" mismatch that kills deals before they even hit the market.

In 2024, the gap between seller expectations and buyer reality is the single biggest hurdle we face as brokers. With interest rates squeezing debt service coverage (DSCR) and buyers becoming more disciplined, the "growth at all costs" mindset of 2021 has been replaced by a focus on fundamentals. Buyers aren't just looking for potential anymore; they are looking for proven cash flow.

This guide is your reality check. It breaks down the 2024 SDE multiples by industry to help you set realistic expectations, defend your valuations, and keep your deals from dying on the vine.

How to Use This Guide

The multiples below represent typical ranges for Main Street businesses (transaction values between $250K and $5M). These figures are derived from 2024 transaction data, including reports from BizBuySell and DealStats.

Key Principles for Brokers:

- Multiples are a Starting Point: Use these to anchor the conversation, not end it.

- The "Quality" Premium: A business with $1M in SDE will almost always command a higher multiple than one with $200K due to lower risk and higher bankability.

- Verify with Comps: Always cross-reference these ranges with recent comparable sales in your specific geography.

SDE Multiples by Industry Sector

Restaurants and Food Service

Current Trend: The restaurant sector has stabilized in 2024, but financing remains tight for new ventures. Established franchises with management in place are trading at the top of these ranges.

Business Type | SDE Multiple | Notes |

|---|---|---|

Quick Service / Fast Food | 1.5x - 2.8x | Premium for drive-thrus and franchises; BizBuySell data shows median ~2.1x. |

Full-Service Restaurants | 1.5x - 2.5x | heavy chef/owner dependency drags this down. |

Bars and Taverns | 1.5x - 2.5x | Liquor license value is often separated or adds a premium. |

Coffee Shops / Cafes | 1.8x - 3.0x | Higher multiples for strong leases and high foot traffic. |

Catering | 2.0x - 3.0x | Relationship-dependent; recurring corporate contracts drive value. |

Food Trucks | 1.0x - 2.0x | Primarily an asset sale; very hard to finance. |

Key Drivers: Location, lease transferability, franchise vs. independent status, and management structure.

Retail Businesses

Current Trend: Inventory management is the name of the game here. Buyers are wary of "dead stock" masquerading as assets. E-commerce businesses continue to command a premium due to scalability, though the "Covid bump" has fully normalized.

Business Type | SDE Multiple | Notes |

|---|---|---|

General Retail | 1.8x - 2.8x | Inventory turnover rate is the critical KPI. |

Specialty Retail | 2.0x - 3.0x | Niche strength (e.g., hobby stores) protects margins. |

E-commerce | 2.5x - 4.0x | Growth rate and gross margins drive the multiple here. |

Convenience Stores | 1.5x - 2.5x | Heavily influenced by gas contracts and location. |

Liquor Stores | 2.5x - 3.5x | High demand due to recession resistance; license value included. |

Auto Parts | 2.0x - 3.0x | Inventory is massive; often priced as Assets + Goodwill. |

Key Drivers: Inventory quality, e-commerce channel mix, and customer loyalty programs.

Service Businesses

Current Trend: This is the hottest sector in 2024. Buyers love the "unsexy" businesses—plumbing, HVAC, and pest control. Why? Recurring revenue. The more contract-based the revenue, the higher the multiple.

Business Type | SDE Multiple | Notes |

|---|---|---|

HVAC / Plumbing / Electrical | 2.5x - 4.0x | Service contracts are gold; median is trending near 2.7x-3.0x. |

Landscaping / Lawn Care | 2.0x - 3.0x | Commercial maintenance contracts > Residential install revenue. |

Cleaning Services | 2.0x - 3.0x | Commercial contracts are valued much higher than residential. |

Auto Repair | 2.0x - 3.0x | Value is in the mechanics and reputation, not just the lifts. |

Pest Control | 3.0x - 4.5x | The "Holy Grail" of recurring revenue models. |

Security / Alarm | 3.0x - 5.0x | RMR (Recurring Monthly Revenue) drives aggressive multiples. |

Fitness / Gyms | 1.5x - 3.0x | Membership retention rates dictate the price. |

Key Drivers: Recurring revenue % (contracts), technician retention, and fleet condition.

Professional Services

Current Trend: High margins, but high transition risk. The "handshake equity" of the owner is the biggest hurdle. Deal structures here almost always involve an earn-out or significant seller note to ensure client retention.

Business Type | SDE Multiple | Notes |

|---|---|---|

Accounting Practices | 2.5x - 4.0x | Median often ~2.15x SDE but 1.0x-1.2x Gross Revenue is common standard. |

Insurance Agencies | 2.0x - 3.5x | Book of business renewal rate is the primary value driver. |

Real Estate Brokerages | 1.5x - 2.5x | Extremely cyclical; heavy reliance on top-performing agents. |

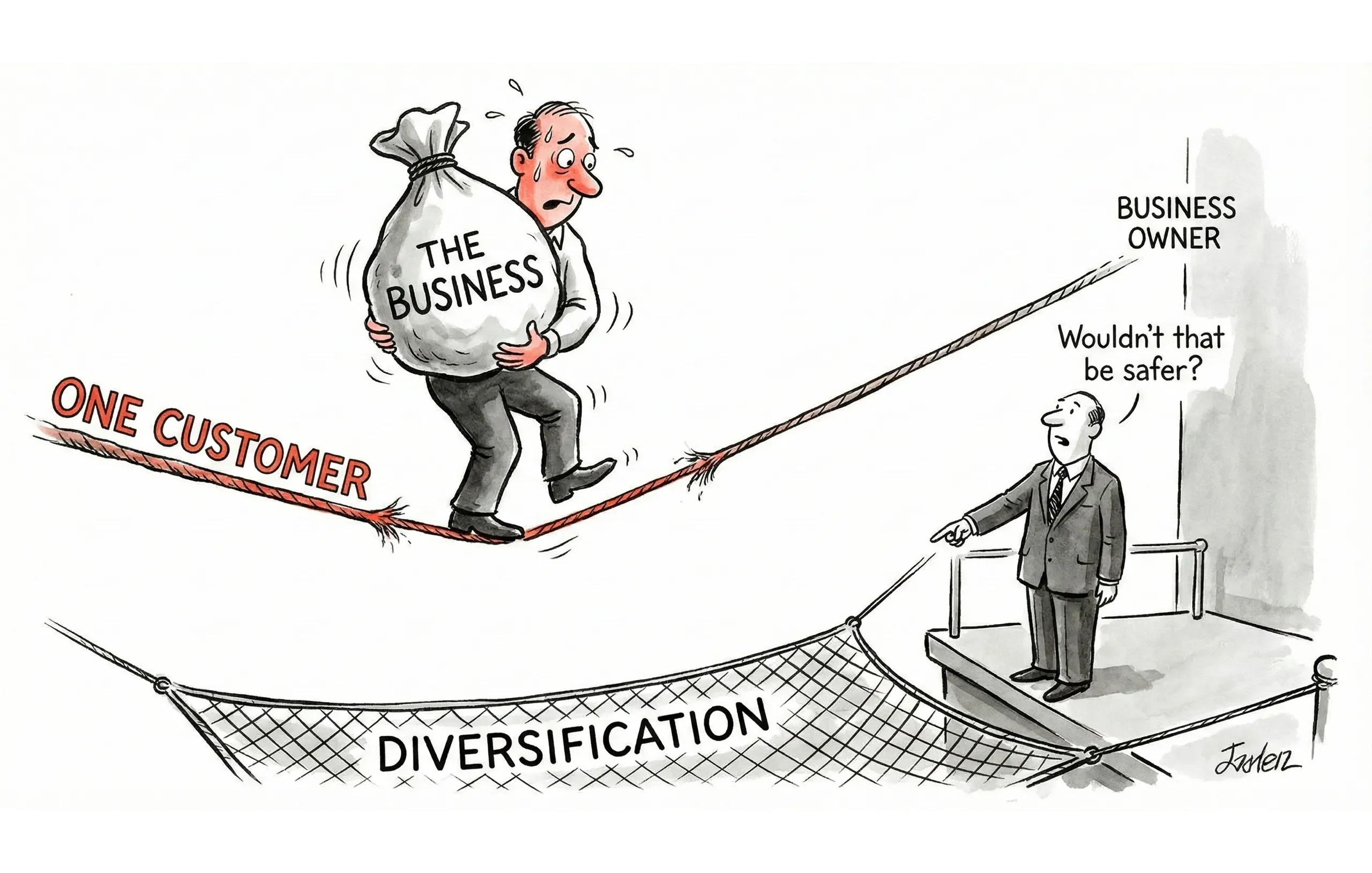

Marketing / Advertising | 2.0x - 3.5x | Client concentration is the #1 deal killer here. |

IT Services / MSP | 2.5x - 4.0x | Managed Service Providers (MSP) with recurring fees see premiums. |

Staffing Agencies | 2.0x - 3.5x | Value fluctuates wildly with the labor market. |

Key Drivers: Client retention rates (churn), owner dependency, and staff stability.

Healthcare and Wellness

Current Trend: Private Equity roll-ups are distorting the upper end of this market, especially in dental and vet clinics. However, for Main Street deals, SDE multiples remain grounded.

Business Type | SDE Multiple | Notes |

|---|---|---|

Medical Practices | 3.0x - 5.0x | Specialty mix and payer mix (Insurance vs. Private Pay) matter. |

Dental Practices | 3.5x - 5.0x | Hygiene department revenue is a key stability indicator. |

Veterinary Clinics | 3.5x - 5.5x | High demand from corporate aggregators driving prices up. |

Physical Therapy | 2.5x - 4.0x | Referral source diversity is critical. |

Home Healthcare | 2.5x - 4.0x | Regulatory compliance and staffing are major risks. |

Pharmacies | 3.0x - 4.5x | PBM (Pharmacy Benefit Manager) contracts dictate margins. |

Key Drivers: Patient base stability, provider dependency, and regulatory compliance.

Manufacturing and Distribution

Current Trend: Buyers are looking for "proprietary" value—patents, custom processes, or exclusive distribution rights. Generic "job shops" without long-term contracts are seeing softer multiples.

Business Type | SDE Multiple | Notes |

|---|---|---|

Light Manufacturing | 2.5x - 4.0x | BizBuySell median ~3.0x; equipment capability is key. |

Custom Fabrication | 2.5x - 3.5x | Skilled labor shortages can discount the multiple. |

Distribution | 2.5x - 4.0x | Exclusive territory rights can push this higher. |

Wholesale | 2.0x - 3.5x | Watch out for high customer concentration. |

Printing | 2.0x - 3.0x | Digital capability vs. offset legacy equipment. |

Machine Shops | 2.5x - 4.0x | Certifications (ISO, AS9100) add significant value. |

Key Drivers: Customer concentration, equipment age/CapEx requirements, and skilled workforce.

Construction and Trades

Current Trend: Backlog is king. A contractor with 12 months of signed work is a sellable business; one chasing bids next week is just a job.

Business Type | SDE Multiple | Notes |

|---|---|---|

General Contractors | 2.0x - 3.5x | "WIP" (Work in Progress) accounting is messy but vital. |

Specialty Contractors | 2.5x - 4.0x | Niche expertise (e.g., glazing, elevator repair) creates value. |

Roofing | 2.0x - 3.0x | Insurance-claim driven models are viewed as riskier. |

Electrical Contractors | 2.5x - 3.5x | License transferability is the first question to answer. |

Plumbing Contractors | 2.5x - 3.5x | Service/Repair mix is valued higher than New Construction. |

Key Drivers: Backlog (signed contracts), bonding capacity, and management team depth (Project Managers/Estimators).

Factors That Move Multiples

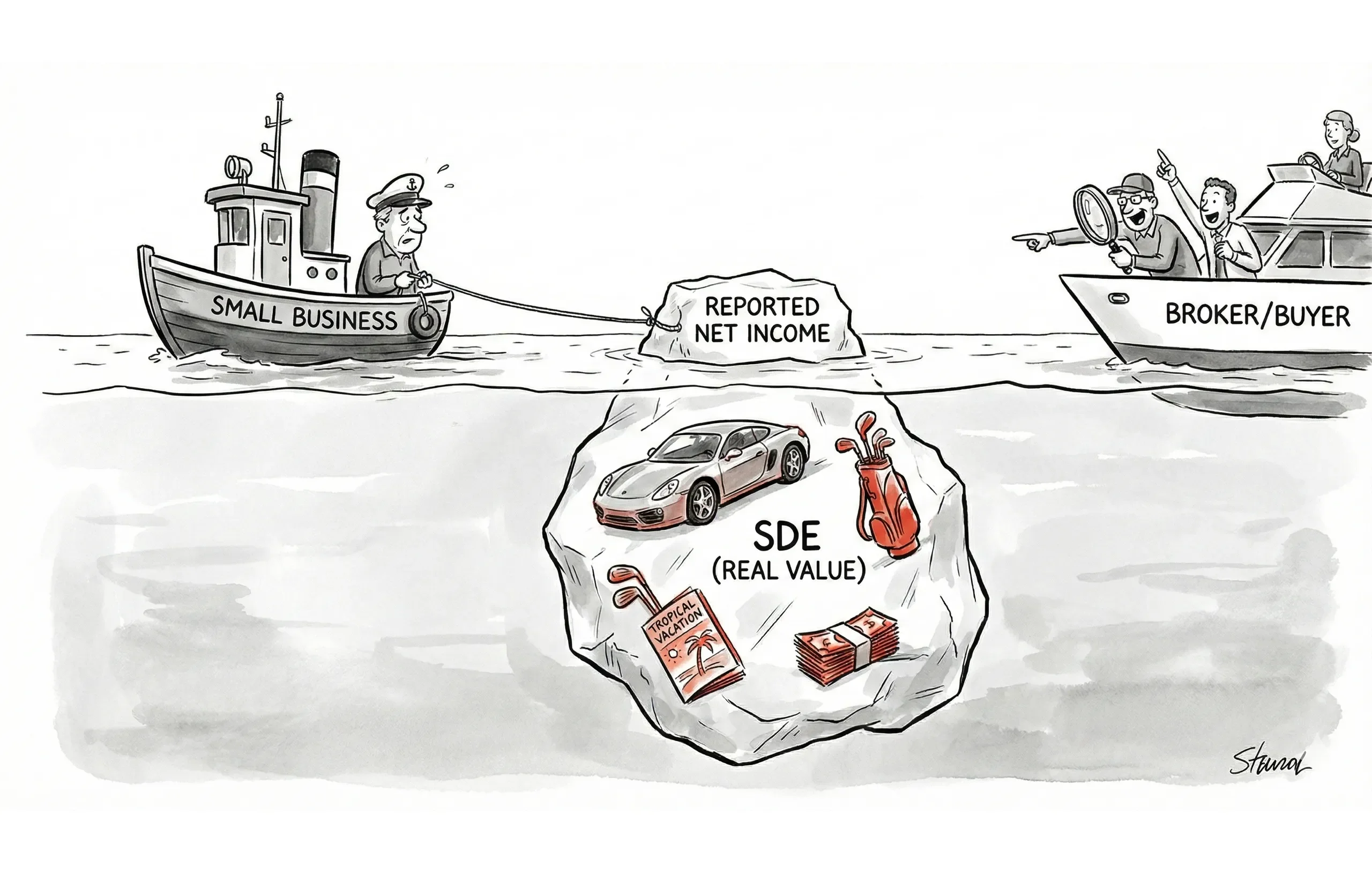

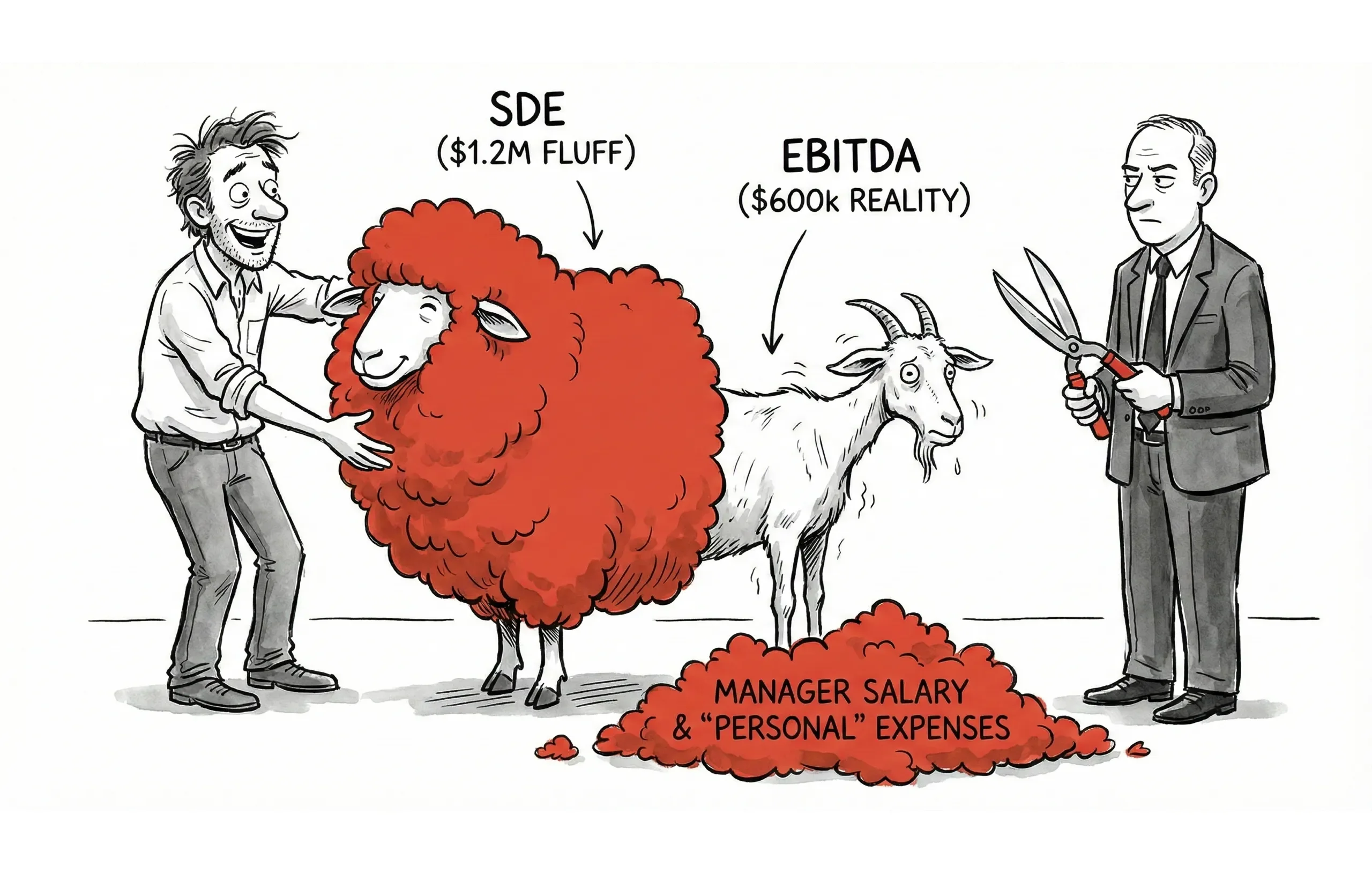

As brokers, we know the "multiple" is just math. The art is in the add-backs and the risk profile. Here is what shifts a business from the bottom of the range to the top.

Premium Factors (+0.5x - 1.0x)

- Recurring Revenue > 50%: Subscription models or automatic contracts.

- Revenue Growth > 15% YoY: Buyers pay for trajectory.

- No Customer > 10%: Diversification equals safety.

- Second-Tier Management: The business runs when the owner is on vacation.

- Proprietary Products/IP: A moat against competitors.

Discount Factors (-0.5x - 1.0x)

- Owner IS the Business: If the owner generates >80% of sales, it's an "earn-out" deal at best.

- Customer Concentration: One client > 25% of revenue is a massive risk.

- Declining Revenue: Catching a falling knife is not a popular strategy.

- Messy Books: "Trust me" doesn't work with SBA lenders.

Multiple Validation: The Reality Check

Before you send that Offering Memorandum (OM), you have to pass the "sanity check."

1. Cross-Check Against Market Data

Don't rely on gut feeling. Pull the comps.

- BizBuySell Insight Reports: Great for broad "Main Street" trends.

- Peer-to-Peer Networks: Ask other brokers in your territory.

- Lender Feedback: Call your preferred SBA lender. Ask them, "If I bring you a $1M EBITDA HVAC deal at a 4.5x multiple, will it cash flow at current rates?" If the answer is no, your valuation is theoretical, not practical.

2. SBA Lending Reality Check

This is where deals go to die in 2024. With interest rates hovering higher than recent history, the Debt Service Coverage Ratio (DSCR) is tight.

- The Math: If a buyer puts 10% down on a 4x SDE deal, the loan payments might eat up 80% of the free cash flow.

- The Result: The bank will kill the deal, or they will demand the seller carry a larger note on "full standby."

- The Fix: Pre-qualify the business with a lender before listing to ensure your multiple is actually financeable.

Conclusion

Valuation in 2025 isn't about hitting a "magic number"—it's about constructing a defensible story backed by data. When you can show a seller why their business falls into a specific range using these benchmarks and lender realities, you move from being a "price negotiator" to a trusted advisor.