Knowing when to send the CIM is one of the most critical skills in business brokerage. Send it too early, and you risk confidentiality breaches. Wait too long, and serious buyers lose momentum.

We've all been there. It's 4:30 PM on a Friday. A lead comes in from a "Cash Buyer" who sounds perfect on paper. They want the details now so they can review over the weekend. You're tired, you want to show the seller some movement, so you hit "Send" on the Confidential Information Memorandum.

Monday morning rolls around. The buyer is ghosting you. Worse, you realize their LinkedIn profile shows they used to work for the seller's biggest competitor. Now you're sweating bullets, hoping they don't leverage that customer concentration data you just handed over on a silver platter.

The CIM contains the crown jewels: adjusted EBITDA, operational secrets, and growth strategies. This definitive guide shows you exactly when to send a CIM, how to qualify buyers first, and the security protocols that protect your deals.

The Golden Rule: Qualify Before You Send the CIM

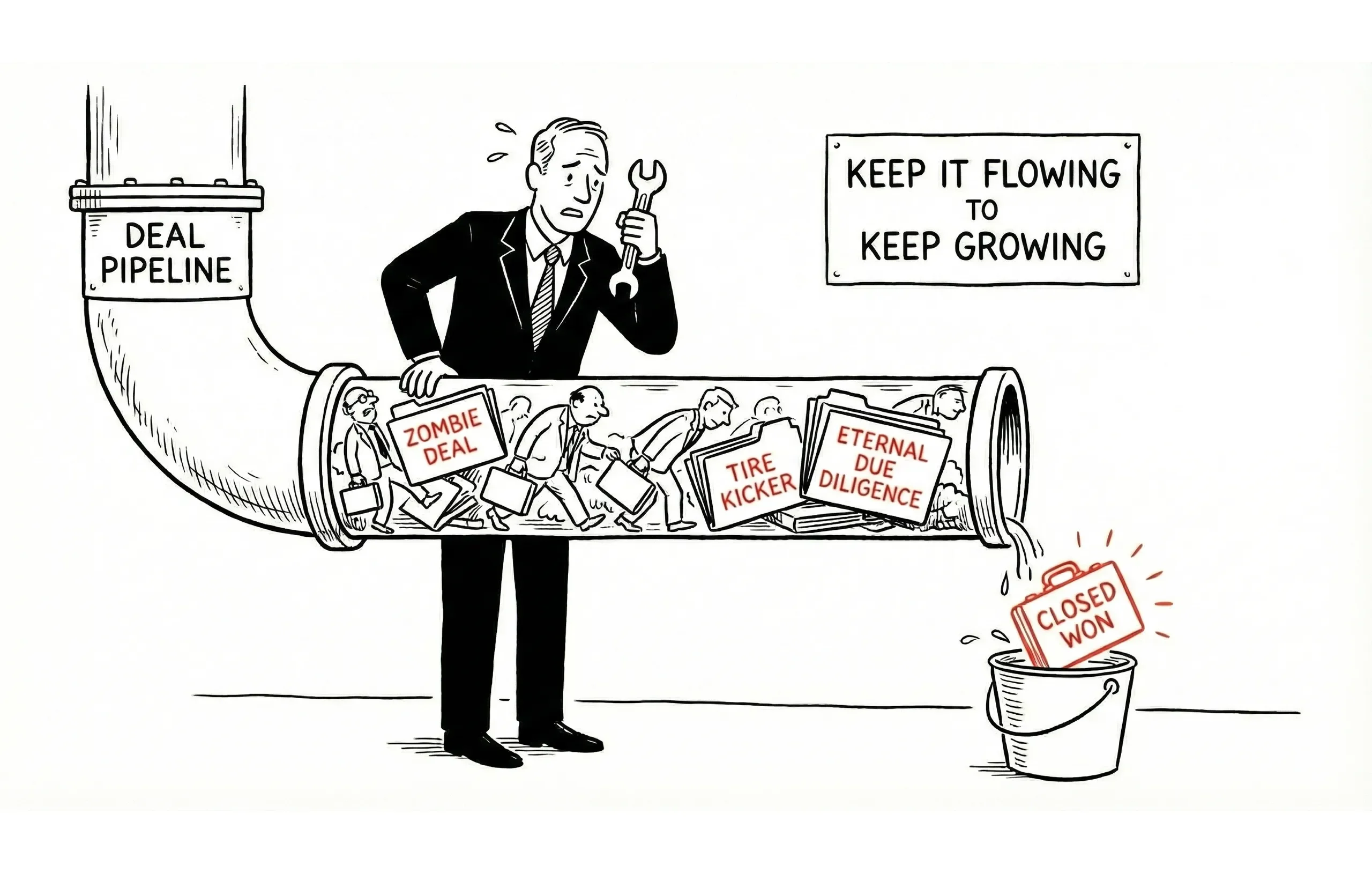

Before we discuss when to send the CIM, let's address the gatekeeping process. According to industry data from BizBuySell, for every 100 inquiries brokers receive, only 2-3 become actual buyers.

If you send a CIM to everyone who asks, you're not a broker—you're a brochure distributor.

The CIM Distribution Prerequisites Checklist

Do not send the CIM until these three boxes are checked. No exceptions.

1. The NDA is Executed

This is non-negotiable. If they won't sign a Non-Disclosure Agreement, they don't see the data.

"Confidentiality is the essence of the business brokerage industry. Without it, you risk the stability of the business you are trying to sell." — IBBA (International Business Brokers Association)

2. The "Proof of Life" (Financial Capability)

You don't need a full bank statement yet, but you need soft proof of funds or a clear explanation of their liquidity. Are they a search fund with committed capital? A strategic buyer with a balance sheet? Or an individual waiting on a HELOC?

3. The Discovery Call

Never send a CIM to an email address without a voice attached to it. A 15-minute call separates the serious players from the data collectors.

When to Send a CIM: The Ideal Distribution Workflow

Think of your deal flow like a funnel. You want to narrow the pool before releasing sensitive data. Here's the exact process for CIM distribution timing:

Stage | Buyer Action | Broker Action | Information Shared |

|---|---|---|---|

1. Inquiry | Clicks ad / Responds to teaser | Review initial profile | Blind Teaser only |

2. Engagement | Requests details | Send NDA & schedule call | NDA Template |

3. Screening | Signs NDA, joins call | QUALIFY (CAMP Method) | Verbal highlights |

4. The Release | Passes screening | SEND CIM | Full Business Profile |

5. Follow-Up | Reviews CIM | Answer Q&A | Detailed financials / Add-backs |

The CAMP Method for Buyer Screening

When you get them on that discovery call, listen for CAMP:

- Capacity: Do they have the money?

- Authority: Are they the decision maker?

- Motivation: Why are they buying now?

- Process: Have they bought a business before?

If they can't answer these questions clearly, keep the CIM in the vault.

When to Send the CIM Immediately

Speed kills deals, but responsiveness saves them. Once a buyer has jumped through your hoops (NDA + Call + POF), you need to move fast.

Send the CIM Within 24 Hours If:

- They asked specific, intelligent questions during the screening call regarding the Blind Teaser

- They have verified "dry powder" (cash or financing) ready to deploy

- Their timeline matches the seller's timeline

- They demonstrated relevant industry experience or acquisition history

Pro Tip: According to Axial's Lower Middle Market Report, deal velocity is a key indicator of closing probability. Engaging a qualified buyer immediately while their interest is piqued increases conversion rates significantly.

Red Flags: When NOT to Send the CIM

Sometimes, even with a signed NDA, your gut tells you something is off. Listen to that instinct. Here's when to delay or modify CIM distribution:

1. The Competitor Dilemma

If a direct competitor asks for the CIM, do not send the standard version.

Best Practice: Create a "Sanitized CIM." Redact customer names, granular pricing strategies, and employee org charts.

The Script: "I'm happy to share the high-level financials, but due to the competitive nature of the industry, we withhold granular customer data until we have an accepted Letter of Intent (LOI)."

2. The "Just Send It" Buyer

If a buyer refuses a 10-minute call and says, "Just send me the deck, I'll let you know if I'm interested," they are likely a tire kicker or a data aggregator.

The Fix: Hold the line. Professional buyers respect professional processes.

3. The Unrealistic Valuation Hunter

If their first question is "What's the lowest price they'll take?" before they even understand the EBITDA adjustments, they aren't looking for value—they're looking for a steal.

4. The Serial Shopper

Buyers who are "looking at 20 deals right now" rarely close. They're building market knowledge on your seller's dime.

CIM Security Best Practices: How to Send It Safely

Never just attach a PDF to a Gmail message. Once that file leaves your outbox, you lose control. Here are the proper methods for sending a CIM:

Level 1: Password Protected PDF

Minimum requirement. Send the password in a separate email or via text message.

Level 2 (Recommended): Virtual Data Room (VDR)

Use tools like DealRoom, Vault, or secure links via Dropbox/DocSend.

Why? You can track who opened it and how long they spent on each page.

The "Gotcha" Moment: If a buyer says, "I read the CIM and the valuation is too high," but your DocSend analytics show they only spent 12 seconds on the file, you know they're bluffing.

Level 3: Watermarked Documents

Add buyer-specific watermarks to each CIM. If it leaks, you know exactly who violated the NDA.

The CIM Follow-Up Strategy

Sending the CIM is not the end of your job—it's the beginning of the negotiation.

The "3-Day Rule"

Wait 3 business days after sending the CIM. Then, pick up the phone.

The Email Hook:

"Hi [Buyer Name], I saw you accessed the CIM on Tuesday. I'm putting together a list of questions for the owner regarding the add-backs schedule. Did you have any specific queries on the financials I should include?"

This is better than "Just checking in," because it assumes they are interested and offers value.

Track These CIM Engagement Metrics:

- Time to first open (should be within 48 hours)

- Total time spent reviewing (serious buyers spend 45+ minutes)

- Pages viewed (did they skip the financials?)

- Return visits (one view suggests casual interest, multiple views suggest serious consideration)

Common CIM Distribution Mistakes to Avoid

Even experienced brokers make these errors when deciding when to send a CIM:

Mistake 1: Sending Before Financial Verification

"They seem serious" is not a qualification standard. Verify financial capability before CIM distribution.

Mistake 2: Using the Same CIM for Every Buyer

Strategic buyers need different information than financial buyers. Customize your approach.

Mistake 3: No Follow-Up System

If you don't have a structured follow-up process after sending the CIM, you're leaving deals on the table.

Mistake 4: Sending on Friday Afternoons

Buyers who receive CIMs on Friday often forget about them by Monday. Tuesday through Thursday mornings yield better engagement.

Advanced CIM Distribution Strategies

Once you've mastered the basics of when to send the CIM, these advanced tactics can improve your close rates:

The "Preview Call" Technique

Before sending the full CIM, schedule a 15-minute "preview call" where you verbally walk through the highlights. This accomplishes two things:

- You can gauge their reaction to valuation before they see it in writing

- You frame the narrative before they form their own opinions

The Staged Release Method

For complex businesses or cautious sellers, consider a two-stage CIM release:

- Stage 1: High-level financials, industry overview, and business model

- Stage 2: Detailed customer breakdowns, employee information, and growth projections (sent only after expressing serious interest)

The Scarcity Principle

When appropriate, let qualified buyers know, "We're sharing the CIM with a limited number of pre-qualified buyers." This creates urgency without being dishonest.

When Multiple Buyers Request the CIM

The best problem to have is too many qualified buyers. Here's how to handle simultaneous CIM distribution:

Create a Buyer Priority System

Tier 1 (Send Immediately):

- All-cash buyers with verified funds

- Strategic buyers with clear synergies

- Buyers with proven acquisition track records

Tier 2 (Send After Tier 1 Feedback):

- SBA-financed buyers (qualified but longer timeline)

- First-time buyers with strong financials

- Out-of-industry buyers with transferable skills

Tier 3 (Hold Until Necessary):

- Buyers with financing contingencies

- Undercapitalized buyers

- Buyers with unclear motivation

The Parallel Track Approach

Don't wait for Buyer A to pass before engaging Buyer B. Send the CIM to all qualified buyers simultaneously, but stagger your follow-ups to maintain leverage.

Legal Considerations for CIM Distribution

Understanding when to send a CIM also means understanding the legal implications:

What Your NDA Must Cover

Before CIM distribution, ensure your NDA includes:

- Definition of confidential information

- Non-solicitation of employees clause

- Non-circumvention language

- Jurisdiction and dispute resolution terms

- Return or destruction of materials clause

Document Your Distribution

Maintain a CIM distribution log with:

- Buyer name and contact information

- Date NDA signed

- Date CIM sent

- Method of delivery

- Follow-up dates and outcomes

This protects you and your seller if confidentiality issues arise.

Summary: Master the Art of CIM Distribution

As a broker, your inventory is confidential information. If you distribute it carelessly, you devalue the asset and risk the seller's business.

By enforcing a strict qualification process, using modern tracking tools, and timing your CIM distribution to match buyer engagement, you stop wasting time with tire kickers and spend more time structuring LOIs.

Key Takeaways: When to Send the CIM

- Never send before: NDA signature, discovery call, and financial qualification

- Send within 24 hours once buyers pass the CAMP screening

- Use secure delivery methods: Virtual data rooms with tracking capabilities

- Follow up systematically: The 3-day rule with value-added outreach

- Protect seller confidentiality: Sanitized CIMs for competitors, watermarked documents for tracking

- Track engagement metrics: Know who's serious based on how they interact with the CIM

- Customize by buyer type: Strategic buyers need different information than financial buyers

The question "when to send the CIM" doesn't have a one-size-fits-all answer, but following this qualification framework ensures you send it at the right time, to the right buyers, with the right protections in place.

Next Steps

Are you struggling to get buyers to sign your NDA promptly? Looking for a template for an "NDA Pre-Frame" email that explains to buyers why your process is so strict, increasing their compliance rate? The right communication strategy can dramatically improve your qualification-to-CIM conversion rate.